The Ultimate Guide to Dental Lab Purchasing

2024-07-14

2025-12-04

The dental industry in Eastern Europe is witnessing a profound shift toward digitalization, with wet-dry hybrid CAD/CAM (Computer-Aided Design/Computer-Aided Manufacturing) milling machines at the epicenter of this transformation. These versatile systems, capable of seamlessly switching between wet and dry processing modes, enable precise fabrication of restorations such as full porcelain crowns, implant abutments, and bridges using a wide array of materials including zirconia, PMMA, glass ceramics, titanium pillars, and titanium disks. In a market where efficiency, cost-effectiveness, and precision are paramount, wet-dry hybrid mills address the unique demands of dental tourism-driven clinics in Poland, Hungary, and the Czech Republic, where tourism accounts for 30-45% of annual revenues.

As of 2025, the European CAD/CAM dental milling machine market is valued at approximately USD 1.24 billion, projected to grow at a compound annual growth rate (CAGR) of 11.6% through 2030, reaching USD 2.5 billion. Eastern Europe, encompassing vibrant dental hubs in Warsaw, Prague, and Budapest, is a key contributor to this expansion, with adoption rates in tourism-oriented clinics surging by 20% year-over-year. Budget-conscious practices, often limiting equipment investments to under €50,000, favor compact, high-value hybrid mills that support same-day restorations and multi-material processing. This article examines the escalating demand for wet-dry hybrid milling machines, highlighting regional drivers, country-specific trends, innovative features, and future prospects through 2030.

Wet-dry hybrid milling machines represent a technological leap in CAD/CAM systems, combining the benefits of dry milling for hard materials like zirconia and PMMA with wet milling's coolant-assisted precision for brittle substances such as glass ceramics and titanium. This dual capability minimizes thermal damage, reduces chipping, and ensures marginal fits under 50 microns, enhancing restoration longevity with survival rates exceeding 97% over a decade. In Eastern Europe, where dental labs and clinics operate under tight margins, these machines optimize workflows by automating processes, saving up to 20% on materials through advanced dust-sealing technologies, and allowing remote monitoring via internal cameras for real-time oversight of milling dynamics.

The demand is propelled by several macro factors. An aging population—projected to increase the 65+ demographic by 18-20% by 2030—heightens the need for durable prosthetics in countries with elevated caries rates. Dental tourism, a booming sector valued at USD 3.54 billion in Europe in 2024 and expected to grow at a CAGR of 21.6% to 2033, draws patients from Western Europe seeking affordable, high-quality treatments at half the cost. In Hungary alone, the dental tourism market anticipates a CAGR of 22.1% from 2025 to 2033, underscoring the region's appeal.

EU regulations, including the 2025 Medical Device Regulation (MDR) updates, mandate compliant, traceable equipment, further incentivizing hybrid mills with robust certifications like CE and FDA. Subsidies from programs such as NextGenerationEU cover 20-30% of investments, making advanced systems accessible to small clinics with 1-3 treatment chairs. Compatibility with popular software like Exocad ensures seamless integration, reducing learning curves and boosting productivity by 30-50% in chairside applications.

Eastern Europe's dental market, valued at around USD 3.7 billion in 2025 and forecasted to reach USD 5.05 billion by 2030 at a CAGR of 6.4%, is increasingly reliant on hybrid milling for tourism-driven efficiencies. Clinics in tourism hotspots prioritize machines with 18-position automatic tool changers for uninterrupted multi-material runs, enabling high-volume processing during peak seasons. Dust-sealing innovations prevent contamination, extending tool life and material yield, while internal cameras facilitate remote diagnostics, minimizing downtime in fast-paced environments.

In Poland, Warsaw and Krakow clinics lead the charge, with the national dental implants market exceeding USD 500 million in 2025. Tourism inflows of over 500,000 patients annually demand same-day services, where hybrid mills process zirconia crowns in under 15 minutes per unit, supporting 50+ cases weekly. Budget sensitivity drives adoption of cost-effective hybrids, yielding ROIs in 6-12 months through reduced lab outsourcing. Polish labs report a 15% annual growth in digital prosthetics, with wet-dry systems cutting material waste by 20% via precise coolant management.

Hungary's Budapest, a premier dental tourism destination, sees clinics generating 35-45% of income from international patients, with the sector growing at 22.1% CAGR. Hybrid mills excel here for titanium disk and pillar milling in implant cases, where high dentist density (15 per 10,000) amplifies demand for automated, remote-monitored equipment. Clinics favor systems with dust-sealing to maintain sterile conditions, achieving 98% on-time delivery for tourism packages that include accommodations and treatments.

The Czech Republic, with Prague as a focal point, mirrors this trend in a market where dental implants are projected to reach USD 452.14 million by 2031 from USD 208.74 million in 2023. Small clinics, handling mixed wet-dry tasks for glass ceramics veneers and PMMA temporaries, benefit from 18-tool changers for versatile, unmanned operations. Remote camera features allow oversight from off-site, crucial for tourism peaks, while material savings of 20% offset import tariffs of 10-15%.

Across the region, surveys from dental associations indicate 65% of labs seek hybrids for multi-material compatibility, addressing the 10% fracture rates in conventional restorations. This demand aligns with the global dental milling machine market's growth from USD 2.98 billion in 2025 to USD 6.17 billion by 2034 at 8.42% CAGR.

Modern wet-dry hybrid milling machines incorporate cutting-edge elements to meet Eastern Europe's needs. Internal cameras provide real-time video feeds for remote monitoring, enabling clinic owners to track milling progress via mobile apps, reducing on-site staffing by 20-30%. This is invaluable for tourism clinics operating extended hours.

With 18 automatic tool changers, these systems handle complex sequences without interruption, processing up to 44 units per batch in materials like zirconia for bridges or glass ceramics for esthetics. Dust-sealing technology captures debris efficiently, saving 20% on materials by minimizing waste and extending spindle life to over 2,000 hours. Compatibility with titanium pillars and disks supports the burgeoning implant market, where Eastern Europe's dental implants sector grows at 9-11% CAGR.

In practice, a Warsaw clinic reported 25% revenue growth post-adoption, attributing it to same-day efficiencies for tourist patients. Similarly, Budapest practices save €25,000 annually on external labs through in-house hybrid milling. These features ensure compliance with EU MDR, with machines often holding CE and FDA certifications for seamless market entry.

Despite strong demand, hurdles include initial costs (€20,000-€50,000) and training curves (1-2 months), particularly in rural areas outside Prague or Budapest. Downtime risks (5-10%) are mitigated by remote monitoring, while tariffs challenge imports—addressed through EU subsidies.

Opportunities abound: As dental tourism surges globally from USD 7.3 billion in 2025 at 11.3% CAGR, Eastern clinics can leverage hybrids for competitive edges. Factories offering tours build trust, showcasing production rigor under ISO standards.

By 2030, Eastern Europe's CAD/CAM milling market could reach €1.4 billion at 13.6% CAGR, with hybrids dominating 60% of adoption. AI integrations will slash processing times by 50%, while bio-compatible expansions enhance titanium applications. Tourism's 18.24% CAGR to USD 17.79 billion amplifies this, positioning Poland, Hungary, and the Czech Republic as hubs.

In conclusion, the demand for wet-dry hybrid milling machines in Eastern Europe's dental market is robust, driven by tourism efficiencies and digital needs. Offering remote monitoring, 18-tool automation, and 20% material savings, these systems empower clinics in Warsaw, Prague, and Budapest to thrive. Early adopters, leveraging EU funds and innovative features, will secure 35% ROIs, transforming practices into global leaders by 2030.

Dry & wet milling for zirconia, PMMA, wax with auto tool changer.

learn more

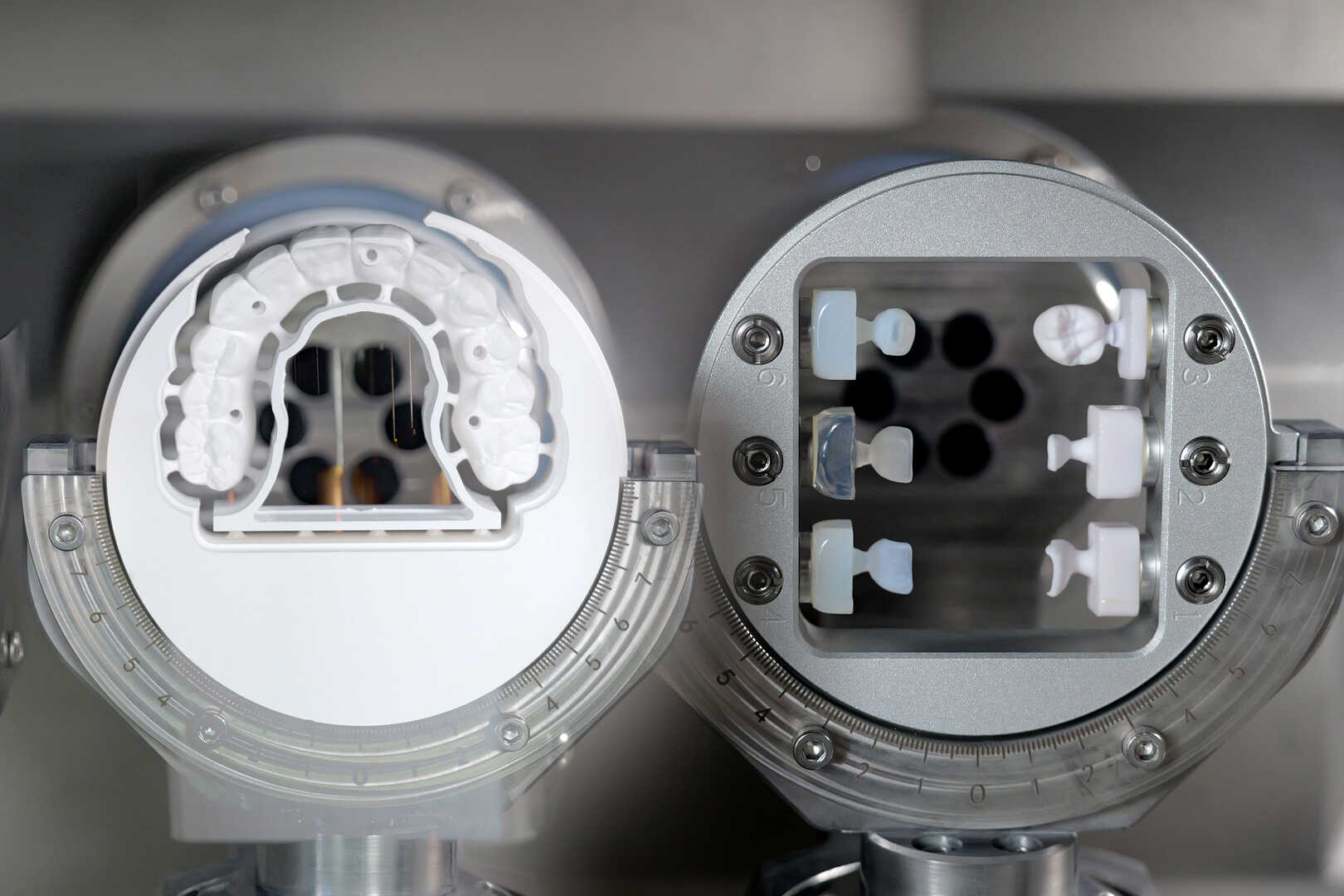

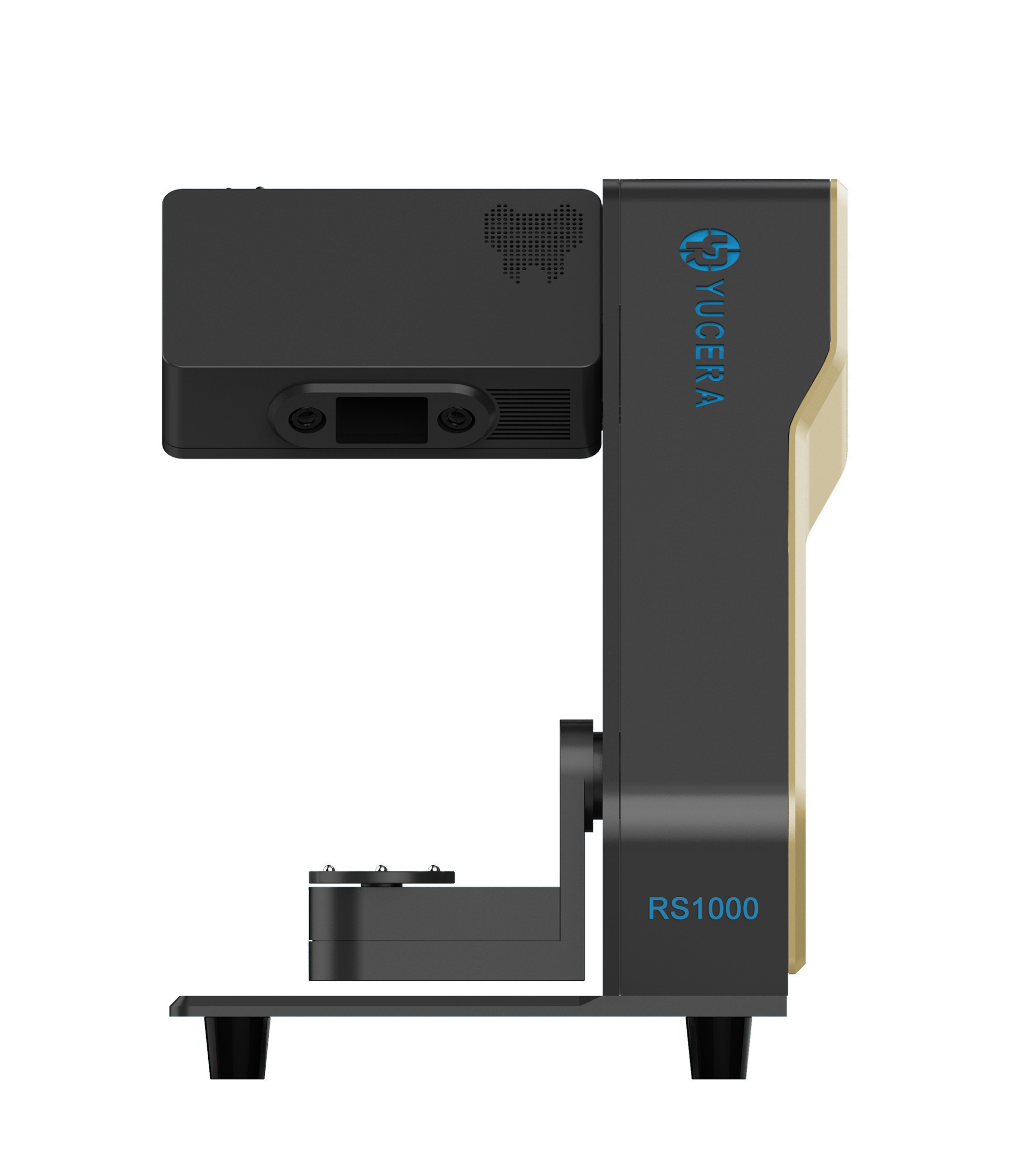

High-precision 3D scanning, AI calibration, full-arch accuracy.

learn more

40-min full sintering with 57% incisal translucency and 1050 MPa strength.

learn more

40-min cycle for 60 crowns, dual-layer crucible and 200°C/min heating.

learn more

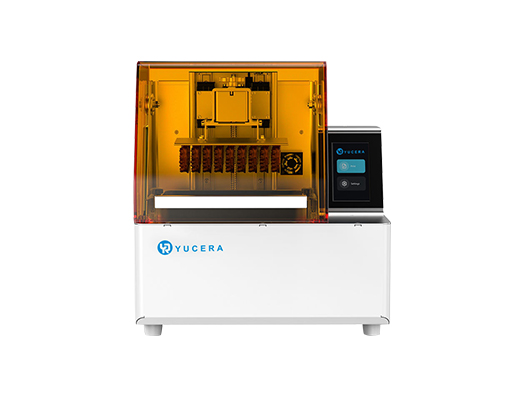

High-speed LCD printer for guides, temporaries, models with 8K resolution.

learn more