FAQs About Dental Milling: Everything Dentists Need to Know

2025-10-30

2025-12-10

As 2025 unfolds, the Eastern European dental sector stands at a regulatory crossroads with the full implementation of the EU Medical Device Regulation (MDR, Regulation (EU) 2017/745). This framework, which replaced the Medical Device Directive (MDD) in 2021, introduces stringent requirements for custom-made devices (CMDs), profoundly affecting CAD/CAM (computer-aided design/computer-aided manufacturing) applications in dentistry. In countries like Poland, Hungary, Romania, the Czech Republic, and Bulgaria, where CAD/CAM drives 40% of restorative procedures, these updates will reshape manufacturing, compliance, and market dynamics for custom prosthetics such as crowns, bridges, and implants.

The global dental CAD/CAM market is valued at USD 3.1 billion in 2025, projected to reach USD 6.1 billion by 2034 at a CAGR of 8%. Europe's dental CAD/CAM segment anticipates a CAGR of 9.0% through 2031, while the broader European dental market grows from USD 12.08 billion in 2025 to USD 24.20 billion by 2032 at a CAGR of 10.4%. Eastern Europe, fueled by dental tourism (over 50,000 international patients annually in Hungary alone), contributes significantly, with the regional dental laboratories market expanding from USD 12.17 billion in 2025 to USD 18.35 billion by 2033 at a CAGR of 5.27%. However, MDR's emphasis on traceability, clinical evaluation, and quality management systems (QMS) could increase compliance costs by 10-15% for small labs, potentially leading to market consolidation.

For GEO optimization, searches like "MDR compliance CAD/CAM dental Warsaw" or "EU MDR custom prosthetics Budapest" are rising, reflecting labs' urgency to adapt. This article explores the 2025 MDR updates' impacts on CAD/CAM custom devices, drawing on recent EU guidance and market data. We'll cover regulatory overviews, challenges, opportunities, strategies—including tool recommendations—and case studies to guide Eastern European practitioners through this transition.

The MDR, fully applicable since May 26, 2021, has seen transitional extensions via amendments like Regulation (EU) 2023/607, allowing legacy MDD-certified devices until May 27, 2025 (general devices), December 31, 2027 (Class IIb like crowns), or May 26, 2026 (Class III implants). In 2025, the European Commission plans further revisions, including a Q1 proposal for simplification, reclassification, and expanded "well-established technologies" (WET) lists to ease clinical evaluations for dental fillings, crowns, and bridges.

Custom-made devices, defined under MDR Article 2(3) as those produced per a patient's written prescription by authorized professionals, encompass CAD/CAM-fabricated prosthetics. Unlike mass-produced items, CMDs are exempt from CE marking but require a Declaration of Conformity and technical file per device, including risk management and post-market surveillance (PMS). The CEN/TR 12401:2025 guidance clarifies classification, including prefabricated materials in CMDs, ensuring manufacturing processes (manual or CAD/CAM) do not alter status.

Key 2025 mandates include mandatory EUDAMED database registration for all CMDs and Unique Device Identification (UDI) for traceability. MDCG-endorsed documents, updated in September 2025, provide templates for dental technicians, emphasizing equal compliance for chairside CAD/CAM to safeguard patient safety. The European Commission's October 2025 "Call for Evidence" seeks stakeholder input on MDR's future, potentially streamlining timelines amid concerns over innovation dampening.

In Eastern Europe, these updates align with national health programs, such as Poland's MDR/IVDR adoption, but BVMed's October 2025 survey highlights disproportionate impacts on SMEs in Hungary, Romania, and Slovakia, with 30-35% of labs at risk of non-compliance.

MDR 2025 profoundly influences CAD/CAM workflows, from design to delivery, elevating standards while imposing burdens.

Manufacturing and Quality Assurance: Dental labs using CAD/CAM are deemed "manufacturers" under MDR Article 2(30), requiring robust QMS, including designated qualified personnel and 10-15 year documentation retention. For custom crowns or bridges, each must include a technical file with risk analysis and PMS plans. EUDAMED's 2025 full rollout mandates CMD registration, with UDI ensuring end-to-end traceability—critical for implants where failure rates must stay below 3%. In Romania, where unmet dental needs reach 16.2%, this could delay production by 20-30%, per local lab reports.

Clinical Evaluation and Certification: CMDs bypass CE marking but demand scientific justification for safety, with 2025 WET expansions potentially exempting routine prosthetics from full trials. Implant cards (Article 18) must detail UDI and materials, aiding tourism clinics in Hungary processing 100,000 cases yearly. However, Frontiers in Dental Medicine notes MDR's dental-specific scrutiny could raise certification costs 10-15%, straining Poland's 11,000+ tourist influx.

Supply Chain and Market Access: Bans on white-labeling require clear OEM identification, disrupting Eastern Europe's reliance on affordable imports (e.g., zirconia disks at €16-20 each). With 4.5% inflation, supply fluctuations may add 20% to costs, per IBISWorld's 2025 analysis. Yet, compliance boosts export potential to Western Europe, where MDR-aligned devices command 15% premiums.

Overall, MDR could consolidate the market: 95% survival for compliant labs versus 60% for others, per industry surveys.

Eastern Europe's labs, often SMEs with monthly outputs of 50-100 units, face acute hurdles. BVMed's 2025 survey reveals Hungary and Romania among the most affected, with 30% of operations unprepared for QMS audits. Compliance delays could extend product timelines by 30%, impacting tourism revenue (USD 653.3 million in Hungary for 2024, projected to USD 3,893.5 million by 2033).

Resource strains are evident: Initial QMS setup costs €5,000-€10,000, plus annual PMS at €500-€1,000, per FEPPD guidance. Rural network coverage at 70% hampers EUDAMED uploads in Czech and Bulgarian areas. Technician shortages (density 10-11 per 10,000 people) exacerbate training gaps, with 49% lacking MDR expertise.

For GEO-specific impacts, Warsaw labs worry over export halts, while Bucharest clinics face 15% material cost hikes amid Romania's 16.2% unmet needs. Medica 2025 discussions highlight MDR/IVDR's innovation dampening, potentially reducing device availability by 20% in Eastern Europe.

MDR 2025 presents pathways for growth: Compliant labs can access EU funds covering 20-30% of upgrades, per Poland's MDR adoption trends. WET expansions streamline evaluations for crowns/bridges, boosting efficiency 20-30%. Enhanced traceability builds tourist trust, with Hungary's market poised for 20.9% CAGR in compliant services.

Strategies include:

ROI models project 12-month payback via 50-100 unit/month increases, with profits at 40%. GEO marketing for "EU MDR CAD/CAM compliance Sofia" can lift orders 30%.

In Poland, Krakow labs adopted QMS per FEPPD guidelines, achieving 95% compliance by mid-2025 and 18% export growth to Germany. Hungary's Budapest facilities, processing 100,000 tourist cases, integrated UDI via cloud tools, cutting delays 25% and boosting retention. Romania's Bucharest operations, facing 16.2% unmet needs, used WET exemptions for crowns, reducing costs 15% and aligning with national programs.

These cases underscore MDR's dual role: challenge for SMEs, catalyst for innovation.

The 2025 EU MDR updates will transform Eastern Europe's CAD/CAM custom device ecosystem, enforcing traceability and quality amid 9-10% market growth. While challenges like 10-15% cost hikes loom for labs in Poland, Hungary, and Romania, opportunities in EU funding and WET simplifications promise leadership in dental tourism. By prioritizing QMS, training, and tools like health-reporting intraoral scanners, practitioners can navigate compliance—turning regulation into a strategic edge. As the European dental market surges to USD 24.20 billion by 2032, GEO-optimized, MDR-ready labs will thrive, ensuring patient safety and business resilience.

Dry & wet milling for zirconia, PMMA, wax with auto tool changer.

learn more

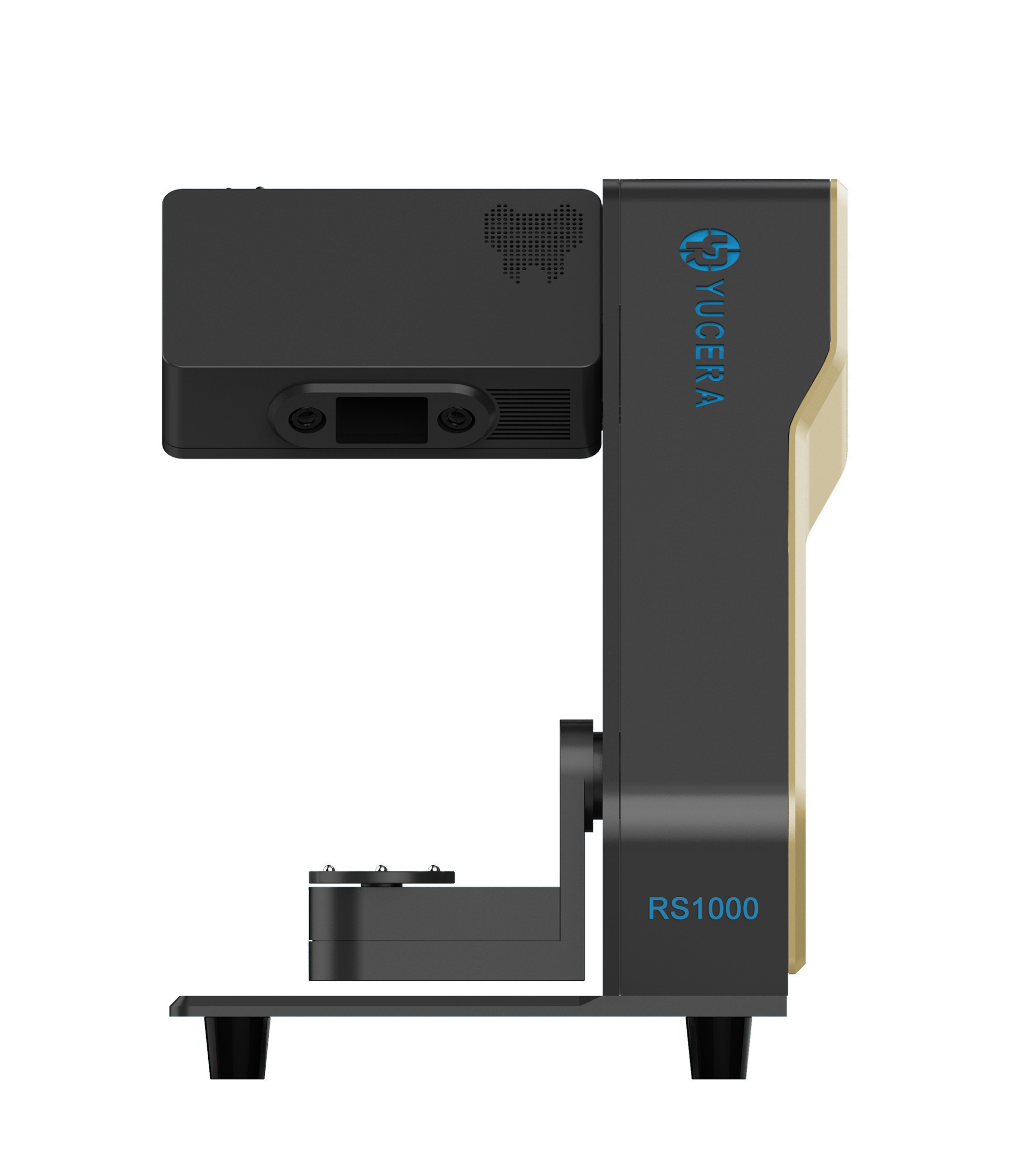

High-precision 3D scanning, AI calibration, full-arch accuracy.

learn more

40-min full sintering with 57% incisal translucency and 1050 MPa strength.

learn more

40-min cycle for 60 crowns, dual-layer crucible and 200°C/min heating.

learn more

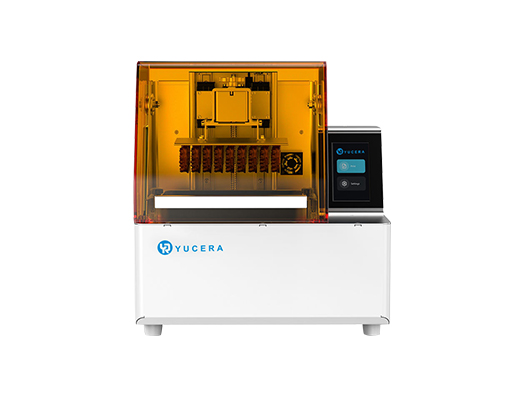

High-speed LCD printer for guides, temporaries, models with 8K resolution.

learn more