Reducing Import Costs: Local Sourcing for Dental Raw Materials in Nigeria

2025-11-15

2025-04-18

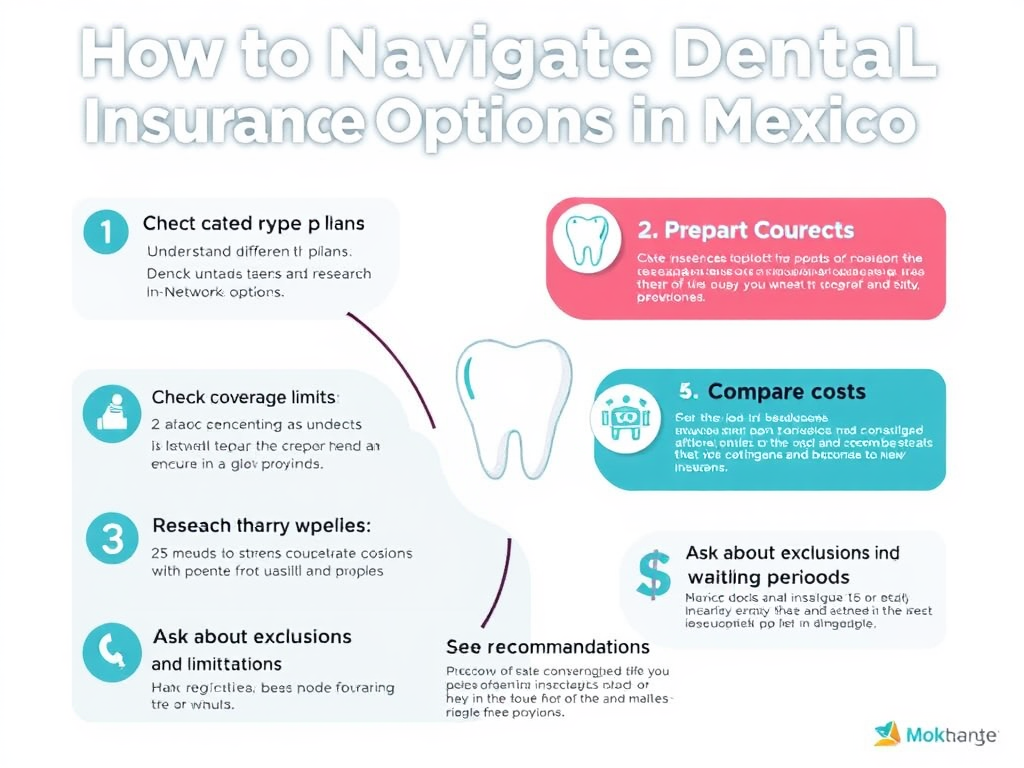

Navigating dental insurance can be a daunting task, especially in a foreign country like Mexico. With various plans and providers, understanding your options is crucial for ensuring you receive the best dental care without breaking the bank. In this blog post, we will guide you through the process of navigating dental insurance options in Mexico.

In Mexico, dental insurance typically falls into two main categories:

· Private Insurance: Offered by various private companies, these plans can cover a range of dental procedures, including routine check-ups, fillings, and major surgeries.

· Public Insurance: The Mexican government provides public health insurance, which may include basic dental care. However, coverage may be limited, and waiting times can be longer.

When considering dental insurance, it’s essential to research different providers. Some well-known companies offering dental insurance in Mexico include:

· MetLife

· GNP Seguros

· Grupo Nacional Provincial (GNP)

· BUPA Mexico

Look for reviews and customer feedback to gauge their reputation and reliability.

Not all dental insurance plans are created equal. When comparing options, consider the following:

· Types of Services Covered: Ensure the plan covers essential services such as preventive care, restorative procedures, and emergency treatments.

· Limits and Exclusions: Be aware of any limits on coverage and specific exclusions that may affect your treatment options.

· Annual Maximums: Check if there’s a cap on how much the insurance will pay per year.

Understanding the costs associated with dental insurance is crucial. Consider:

· Monthly Premiums: Calculate how much you’ll need to pay each month for coverage.

· Deductibles: Determine how much you’ll need to pay out-of-pocket before the insurance kicks in.

· Co-pays and Coinsurance: Familiarize yourself with any co-pays for visits or treatments and the percentage of costs you’ll be responsible for after the deductible.

Many dental insurance plans have networks of preferred providers. To maximize your benefits:

· Find In-Network Dentists: Use the insurance provider’s website or customer service to locate dentists who accept your plan.

· Verify Acceptance: Before scheduling an appointment, confirm that the dentist accepts your insurance to avoid unexpected costs.

Understanding how to file claims is essential for smooth reimbursement. Key points include:

· Submitting Claims: Learn how to submit claims for services rendered, whether electronically or via paper forms.

· Documentation: Keep all receipts and treatment records, as these may be required for reimbursement.

Before committing to a dental insurance plan, read the policy documents thoroughly. Pay attention to:

· Terms and Conditions: Understand the specifics of what is and isn’t covered.

· Cancellation Policies: Know the procedures for canceling your plan if needed.

If your primary dental insurance doesn’t cover all your needs, consider supplemental insurance. These plans can provide additional coverage for specific procedures or services not included in your primary plan.

Navigating dental insurance options in Mexico doesn’t have to be overwhelming. By understanding the types of insurance, researching providers, comparing coverage, and familiarizing yourself with costs and claims processes, you can make informed decisions that protect your dental health. With the right insurance, you can enjoy quality dental care while managing your expenses effectively. Don’t hesitate to seek guidance from insurance agents or dental professionals to find the best plan for your needs!

Dry & wet milling for zirconia, PMMA, wax with auto tool changer.

learn more

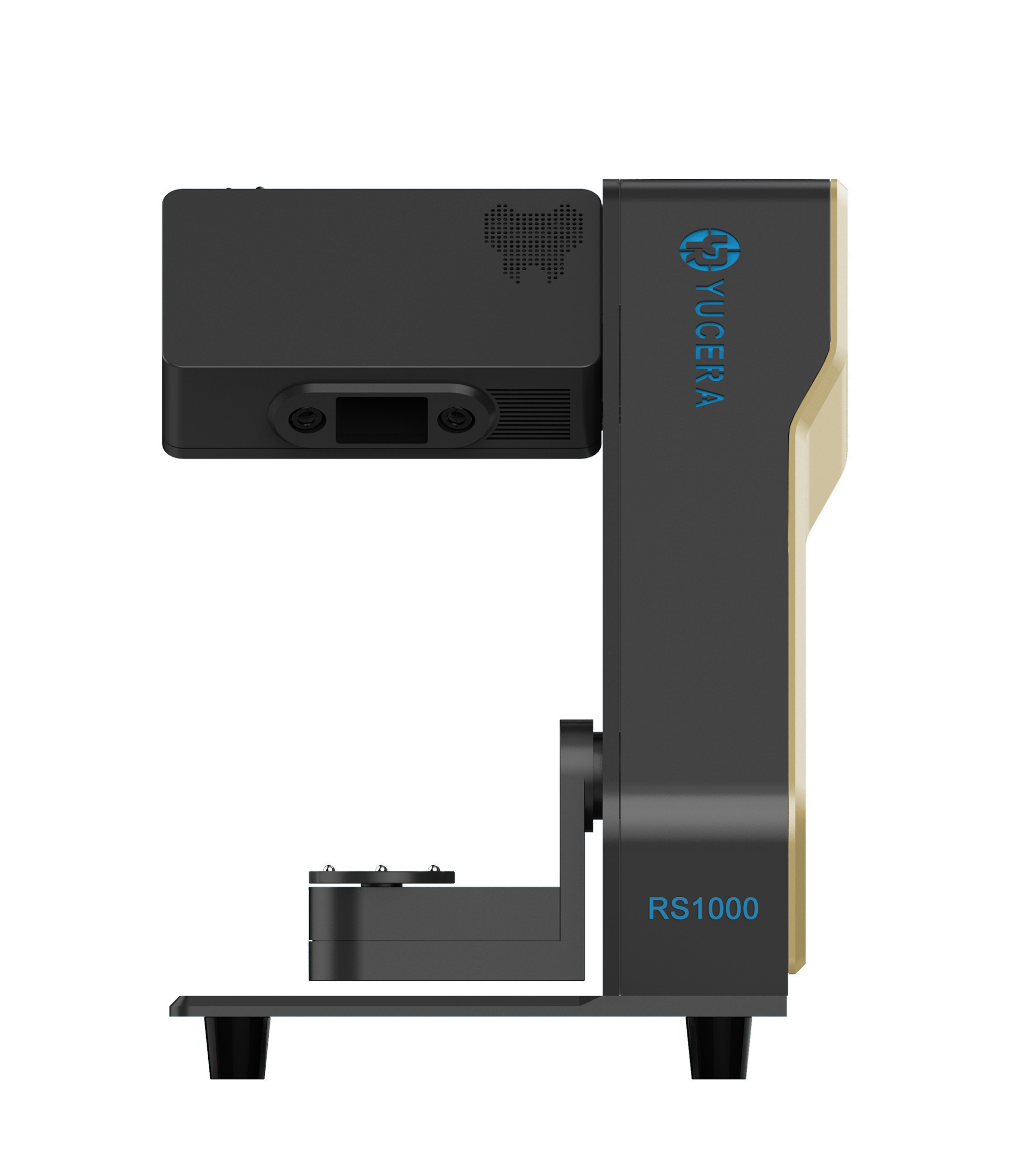

High-precision 3D scanning, AI calibration, full-arch accuracy.

learn more

40-min full sintering with 57% incisal translucency and 1050 MPa strength.

learn more

40-min cycle for 60 crowns, dual-layer crucible and 200°C/min heating.

learn more

High-speed LCD printer for guides, temporaries, models with 8K resolution.

learn more