How to Choose the Right Dental Implant Provider in Mexico

2025-04-15

2026-02-07

Dental 3D printing has emerged as a transformative technology in the Asia-Pacific (APAC) region, enabling faster, more precise, and cost-effective production of crowns, bridges, aligners, surgical guides, and dental models. As of 2026, APAC stands out as the fastest-growing market globally for dental 3D printing, driven by rising oral health awareness, expanding middle-class populations, government initiatives, and booming dental tourism.

While North America still leads in absolute market share, APAC's rapid adoption reflects its large patient base, improving healthcare infrastructure, and increasing disposable incomes. This article examines the current adoption landscape, country-specific trends, key drivers, challenges, and future projections to provide dental professionals, labs, and policymakers with actionable insights.

The Asia-Pacific dental 3D printing market was valued at approximately USD 3.55 billion in 2024 and is projected to reach USD 9.98 billion by 2032, reflecting a strong compound annual growth rate (CAGR) of around 13.8%. Other analyses highlight even higher momentum: APAC accounted for roughly 24% of the global dental 3D printer segment (valued at ~USD 1.28 billion in 2025) with a CAGR exceeding 30% through 2033.

Broader dental 3D printing market figures show APAC growing at 27.1% CAGR (Grand View Research), outpacing global averages of 20-26%. This surge aligns with the overall APAC dental market, valued at USD 8.26 billion in 2024 and expected to hit USD 22.09 billion by 2032.

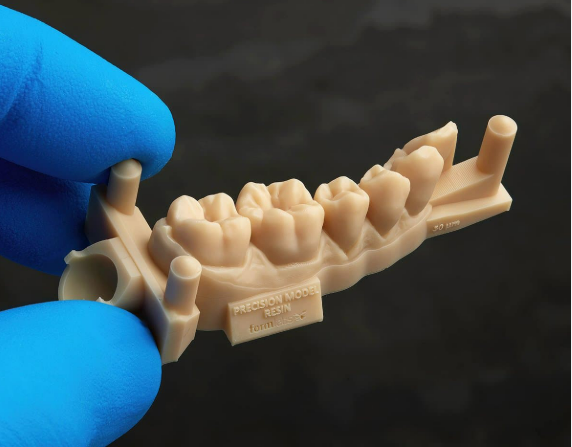

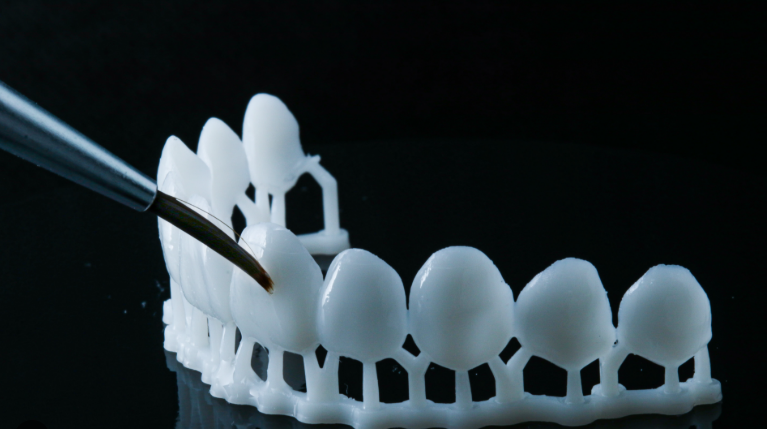

Adoption is concentrated in urban dental labs and clinics, where 3D printing reduces turnaround times from days to hours and minimizes material waste. Common applications include:

Vat photopolymerization (e.g., DLP/SLA) leads technology adoption due to its precision for detailed restorations, while resins remain the top material segment.

China dominates the APAC market, holding the largest share thanks to its massive population, rapid urbanization, and government support for digital healthcare. China's dental market reached USD 2.62 billion in 2024, with 3D printing adoption accelerating in major cities like Shanghai and Beijing. The number of dental clinics and labs using 3D printers has grown significantly, driven by local manufacturing and rising demand for cosmetic and implant procedures.

India is the fastest-growing sub-market, with the Indian Dental Association reporting 20-30% annual growth in the dental sector. Adoption is rising in metropolitan areas (Delhi, Mumbai, Bangalore) for aligners and models, supported by cost-sensitive labs and dental tourism. Rural penetration remains low but is improving via mobile clinics and training programs.

Japan benefits from advanced infrastructure and an aging population (over 29% aged 65+). Adoption focuses on high-precision applications like implant guides and prosthetics. Government initiatives promoting digital dentistry have boosted uptake in Tokyo and Osaka clinics, though growth is steadier compared to emerging markets.

South Korea leads in cosmetic dentistry and dental tourism, with strong adoption of 3D printing for aligners and veneers. High disposable incomes and tech-savvy practices drive rapid integration.

Australia sees steady growth supported by favorable government policies and high dental disease incidence. Adoption is prominent in private clinics for surgical planning and models.

Southeast Asia (Thailand, Vietnam, Indonesia) benefits from dental tourism hubs like Bangkok. Thailand's market grows quickly due to affordable, high-quality 3D-printed restorations attracting international patients.

Overall, urban private labs and hospitals lead adoption (70-80% of installations), while public sectors and rural areas lag due to cost barriers.

Despite rapid growth, adoption faces hurdles:

These factors create a divide between urban innovators and broader markets, with penetration rates estimated at 15-25% in leading APAC countries versus under 5% in less developed areas.

By 2030, APAC dental 3D printing is projected to contribute significantly to the global market (potentially 30-35% share). Key trends include:

China and India will continue leading volume growth, while Japan and South Korea drive innovation in precision applications. If training programs and cost reductions continue, adoption could double in the next 5-7 years.

The adoption of dental 3D printing in Asia-Pacific is at an inflection point in 2026. With market values exceeding USD 3.5 billion and CAGRs of 25-30%, the region is poised to outpace global averages, offering unprecedented opportunities for efficiency, customization, and patient satisfaction.

Dental professionals and labs investing now—through training, strategic partnerships, and technology upgrades—will gain a competitive edge. For clinics and labs across China, India, Japan, and beyond, embracing 3D printing is no longer optional but essential for meeting rising patient expectations in the digital dentistry era.

Stay ahead by monitoring regional regulatory updates and technological innovations. The future of precise, accessible dental care in APAC is being printed today.

Dry & wet milling for zirconia, PMMA, wax with auto tool changer.

learn more

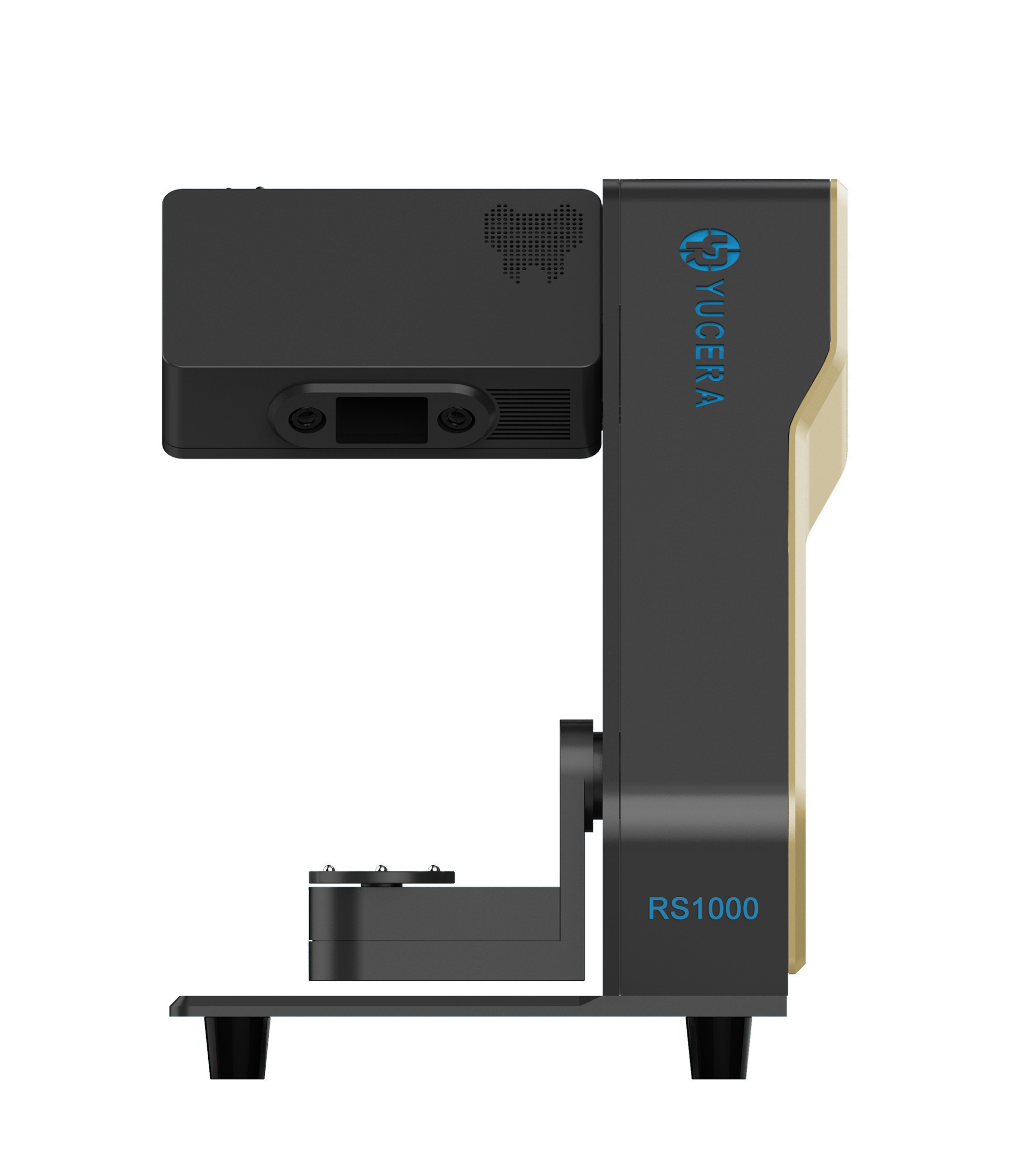

High-precision 3D scanning, AI calibration, full-arch accuracy.

learn more

40-min full sintering with 57% incisal translucency and 1050 MPa strength.

learn more

40-min cycle for 60 crowns, dual-layer crucible and 200°C/min heating.

learn more

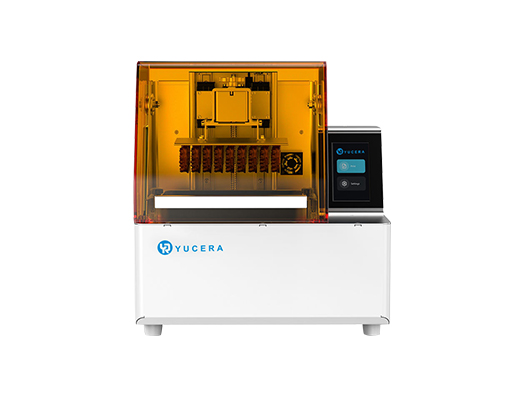

High-speed LCD printer for guides, temporaries, models with 8K resolution.

learn more