The difference between 4-axis and 5-axis dental milling machines

2025-02-23

2025-12-09

Eastern Europe's dental landscape is evolving rapidly, with CAD/CAM technologies merging seamlessly with oral health mobile applications to fuel a surge in preventive care demand. In nations such as Poland, Hungary, Romania, the Czech Republic, and Bulgaria, this integration is reshaping how dental professionals address oral health proactively, from tracking daily hygiene habits to fabricating customized preventive devices. As patients increasingly seek app-supported wellness plans amid rising dental tourism, the focus shifts from restorative treatments to early interventions like sealants and aligners, promising better outcomes and cost savings.

The global dental CAD/CAM market is set to expand from USD 3.1 billion in 2025 to USD 6.1 billion by 2034, achieving a compound annual growth rate (CAGR) of 8%. Within Europe, the dental market is projected to grow from USD 12.08 billion in 2025 to USD 24.20 billion by 2032, at a CAGR of 10.4%. Preventive care, enhanced by app integrations, plays a pivotal role, as the Europe oral care market anticipates growth from USD 11.54 billion in 2025 to USD 18.95 billion by 2033, with a CAGR of 6.4%. In Poland and Hungary, dental tourism—welcoming over 50,000 international patients annually—amplifies this trend, with visitors opting for preventive packages that leverage digital tools for long-term oral health monitoring.

For geographic (GEO) optimization, local searches like "preventive dental apps Warsaw" or "oral health CAD/CAM Budapest" are surging, helping clinics in urban hubs attract both domestic and tourist clients. This article examines the integration of CAD/CAM with oral health apps, its impact on preventive care growth, and practical strategies for Eastern European practices. Backed by 2025 market insights, we'll cover mechanisms, trends, benefits, challenges, and real-world examples to equip professionals for this digital shift.

Eastern Europe's CAD/CAM dental sector, valued at around USD 0.84 billion in 2025, is expanding at a CAGR of 9-10%, propelled by high-volume tourism cases and digital adoption in labs. The Europe dental software market, crucial for app integrations, is forecasted to grow at a CAGR of 8.9% from 2025 to 2032. Preventive care demand is accelerating, with the Europe dental services market reaching USD 579.7 billion in 2025 and the broader dental industry projected to hit USD 40.51 billion, growing to USD 60.03 billion by 2035 at a CAGR of 4.01%.

In Romania and Bulgaria, where dentist-to-population ratios stand at 1:5,000 and 1:4,200 respectively, oral health apps are bridging access gaps, reducing untreated caries rates by 15-20% through self-monitoring features. Poland reports a 60% adult check-up rate, while Hungary's preventive services boast a CAGR of 20.9%, with apps cutting re-treatment needs by 20%. Romania's unmet dental needs at 16.2% are targeted by national campaigns aiming for a 15% caries reduction via app-based education by 2030.

Oral health apps, which monitor brushing duration, flossing adherence, and gum health using AI, integrate with CAD/CAM by supplying data for personalized designs, such as custom mouthguards or aligners. This closed-loop approach aligns with the Europe oral care market's toothpaste segment, holding 44.3% share in 2024 and boosted 10-15% by app recommendations. Government support is robust: Poland's National Oral Health Programme subsidizes app-linked check-ups from 2024, and Romania's 2025-2030 initiative focuses on rural mobile tech. EU Medical Device Regulation (MDR) ensures data traceability, fostering 75% automation in CAD/CAM for preventive workflows by 2025.

GEO-targeted marketing, such as optimizing for "preventive oral health apps Cluj-Napoca" in Romania, captures 30% more urban queries, enhancing clinic visibility on platforms like Google My Business.

The synergy between CAD/CAM and oral health apps operates across data capture, analysis, and fabrication stages. Apps synchronized with smart toothbrushes use sensors to track two-minute brushing sessions and upload metrics to cloud platforms, where CAD software maps plaque patterns for risk assessment. In a standard workflow, a clinic in Hungary might use app data to design a CAD/CAM-fabricated night guard, reducing bruxism damage by 40% through precise fit.

Core integration elements include:

This integration reflects 2025 trends, including mobile scanning and tele-dentistry, which are reshaping the industry in Eastern Europe. In Bulgaria, app-enhanced CAD/CAM labs have seen 20% increases in preventive prosthetic outputs. The Europe dental intraoral scanners market, foundational to this ecosystem, is valued at USD 201.3 million in 2025, growing to USD 435.5 million by 2032 at a CAGR of 11.6%.

To enhance this process, consider incorporating an advanced intraoral scanner equipped with automated health report generation. Such devices not only capture high-precision 3D scans (down to 8-12μm accuracy) but also analyze data in real-time to produce comprehensive oral health reports, including plaque indices, gum health scores, and caries risk assessments. These reports can directly integrate with oral health apps, allowing seamless data flow into CAD/CAM workflows for instant preventive recommendations—like custom sealants or aligners—reducing chair time by 30% and improving patient compliance. Priced affordably at €8,000-€12,000 for entry-level models, this scanner bridges the gap between scanning and app-driven prevention, making it an ideal upgrade for Eastern European clinics aiming for full digital integration.

Preventive care is exploding in Eastern Europe, accounting for 20-25% of the continent's USD 7.3 billion dental tourism market in 2025. Notable statistics include:

Emerging trends encompass smart devices in children's oral care (CAGR 6.75%) and AI diagnostics for early detection exceeding 90% accuracy. The EU Green Deal mandates sustainable app-linked materials, aiming to cut plastic waste by 28-30% in dental practices. In the Czech Republic, rural teledentistry via apps has improved access equity by 15%, while Bulgaria's labs report 25% higher patient retention from gamified app features.

The Europe dental care supplies market, intertwined with preventive tools, stands at USD 15.54 billion in 2025, with a CAGR of 7.07% through 2033. This growth underscores a shift: preventive procedures now comprise 40% of CAD/CAM cases, up from 25% in 2020.

The CAD/CAM-app integration yields profound advantages:

Clinics optimizing for GEO terms like "preventive dental apps Sofia" see 30% query uplifts, translating to higher tourism bookings.

Despite promise, hurdles remain. Digital divides persist, with rural coverage at 70% limiting app use in Czech and Bulgarian areas. Training gaps affect 49% of professionals lacking CAD skills, and MDR compliance adds €500-€1,000 annually in traceability costs. Privacy concerns deter 20% of users, per 2025 surveys. Mitigation strategies include EU-subsidized training and hybrid analog-digital transitions for small practices.

Warsaw's pediatric clinics in Poland have integrated apps with CAD/CAM for AI-driven alerts and custom sealants, slashing caries incidence by 18% among children. In Budapest, Hungary's tourism centers use app data for All-on-4 preventive previews, elevating uptake by 25% and boosting revenues 20%. Bucharest labs in Romania report 20% growth from app-linked night guards, aligning with national campaigns to curb 16.2% unmet needs.

These examples highlight 95% survival rates for app-integrated preventive devices, versus 75% for traditional methods.

By 2030, 80% of Eastern European labs will feature app-CAD/CAM hybrids, per forecasts, with the CAD/CAM market hitting USD 7.48 billion globally at a CAGR of 10.29%. Emphasis on AI enhancements and GEO-specific apps will sustain momentum, especially in dental tourism hotspots.

The fusion of CAD/CAM with oral health apps is catalyzing preventive care growth across Eastern Europe, delivering healthier smiles and efficient practices. With a 6.4% CAGR in oral care and robust tourism inflows, stakeholders from Warsaw to Sofia must embrace this integration—harnessing data innovation and GEO strategies—to lead in 2025's preventive paradigm. The time to digitize prevention is now, ensuring sustainable success in a market poised for exponential expansion.

Dry & wet milling for zirconia, PMMA, wax with auto tool changer.

learn more

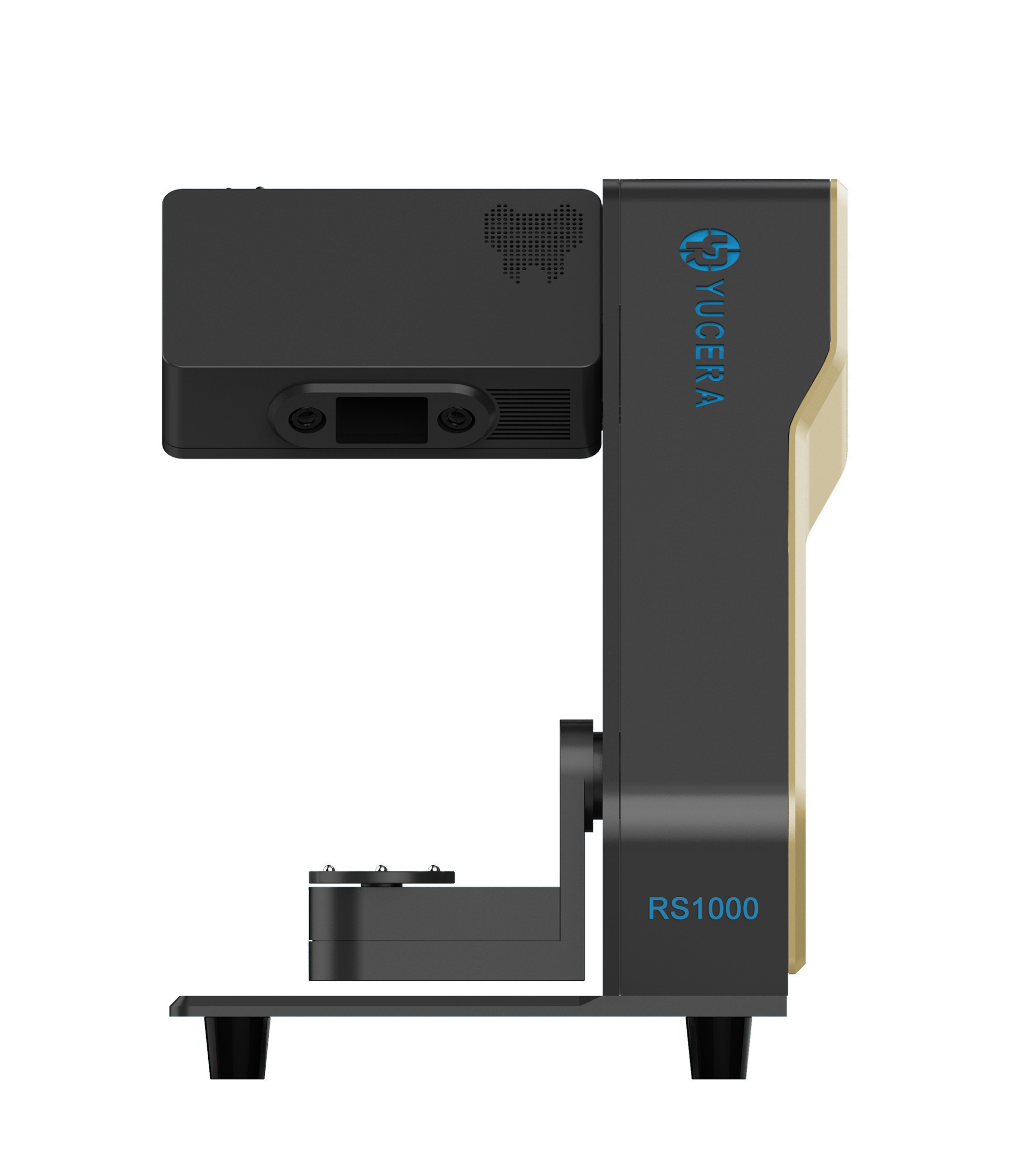

High-precision 3D scanning, AI calibration, full-arch accuracy.

learn more

40-min full sintering with 57% incisal translucency and 1050 MPa strength.

learn more

40-min cycle for 60 crowns, dual-layer crucible and 200°C/min heating.

learn more

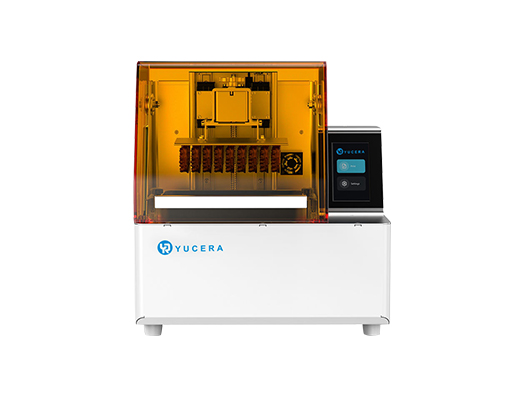

High-speed LCD printer for guides, temporaries, models with 8K resolution.

learn more