How Much Does a Dental Milling Machine Cost?

2025-10-28

2025-12-02

As the global dental CAD/CAM market is forecasted to expand from USD 3.1 billion in 2025 to USD 6.1 billion by 2030 at a CAGR of 10.29%, Eastern Europe stands out as a burgeoning hub due to its cost-effective healthcare, rising dental tourism, and EU-funded digital initiatives. Countries like Poland, Hungary, Romania, Bulgaria, Czech Republic, Slovakia, and Lithuania are accelerating adoption, with the European CAD/CAM dental milling machine market projected to grow at a CAGR of 11.6% from 2025 to 2030. Small clinics, which constitute over 70% of practices in Poland and Hungary, are particularly poised to benefit from wet milling's precision for glass ceramics, enhancing efficiency and patient appeal in a market valued at approximately €3.7 billion in 2025, expected to reach €5.05 billion by 2030 at a CAGR of 6.4%.

This article explores the development prospects of chairside CAD/CAM same-day restorations with wet milling for glass ceramics in Eastern Europe's small dental clinics, covering current trends, market forecasts, benefits, challenges, and future innovations. With a focus on geo-specific growth in key countries, it highlights how this technology aligns with regional demands for affordable, high-quality dentistry.

Wet milling in chairside CAD/CAM systems involves using compact 5-axis machines that process glass ceramics under a continuous coolant stream, preventing thermal damage and ensuring marginal integrity with fits often under 50 microns. Glass ceramics, prized for their translucency and strength (up to 400 MPa flexural strength), are ideal for anterior restorations where esthetics are paramount. Unlike dry milling, which suits zirconia, wet milling excels for brittle materials like lithium disilicate by reducing cracks and improving surface smoothness, which facilitates easier polishing and higher patient satisfaction.

In Eastern Europe, where labor costs are lower (dental technicians earn €1,000-€1,500 monthly, half of Western European averages), small clinics can afford entry-level wet milling setups, supported by EU subsidies covering 20-30% of costs. The dental glass ceramic milling machine market globally is set to reach USD 1,178 million by 2031 at a CAGR of 8.5%, with Europe contributing significantly due to regulatory emphasis on biocompatible materials. In 2025, the market size for these machines in Europe is estimated at USD 1,199 million, reflecting robust demand for same-day solutions.

The process begins with intraoral scanning for digital impressions, followed by software-driven design and wet milling, often integrated with 3D printing for hybrid workflows. This enables clinics to produce restorations in hours, aligning with the region's high caries rates and aging population (65+ demographic rising 18-20% by 2030). Survival rates for wet-milled glass ceramic restorations exceed 97% over 10 years, making them a reliable choice for small practices seeking to differentiate in competitive markets.

The prospects for wet milling in chairside CAD/CAM are promising, with the global dental milling machine market valued at USD 2.64 billion in 2025, projected to reach USD 3.89 billion by 2030. In Eastern Europe, growth is accelerated by dental tourism, a sector expected to grow from USD 7.70 billion in 2025 to USD 17.79 billion by 2030 at a CAGR of 18.24%. This influx of patients from Western Europe drives adoption of digital technologies, with digitized clinics capturing 60% of restorative procedures.

In Poland, the largest market, small clinics in Warsaw and Krakow anticipate 12-16% annual revenue growth, with the dental CAD/CAM segment expanding at 9-11% CAGR through 2030. Wet milling for glass ceramics supports tourism packages, where treatments cost half of Western prices, boosting occupancy by 20-30%. Hungary's market, valued at €3-4 billion in 2025, projects 15-20% growth, with Budapest clinics leading in same-day esthetic restorations. Romania and Bulgaria, with markets around €2.5-3.5 billion, expect 12-15% CAGR, aided by high dentist densities (Bulgaria: 15.6 per 10,000) and EU funds.

The European dental laboratories market, projected to grow from USD 12.17 billion in 2025 to USD 18.35 billion by 2033 at 5.27% CAGR, underscores the shift toward in-house milling in small clinics. By 2030, the regional CAD/CAM market could reach €1.4 billion at 13.6% CAGR, with wet milling comprising a growing share for glass ceramics due to its suitability for minimally invasive procedures.

Wet milling offers tailored advantages for Eastern Europe's small clinics:

1. Precision and Esthetics: Cooling during milling prevents microcracks in glass ceramics, yielding smoother surfaces that require less post-processing and enhance translucency for natural-looking restorations.

2. Efficiency Gains: Same-day workflows reduce chair idle time by 30-50%, allowing 20% more patients daily. In Slovakia, where dentist density is high, this maximizes throughput for tourism-driven demand.

3. Cost Savings: Per-unit costs drop to €20-€40 versus €50-€100 for labs. Remote design outsourcing to Ukraine cuts expenses by 50% in Romania.

4. Patient Attraction: Tourists in Hungary's Budapest value quick esthetic fixes, increasing satisfaction by 15-25% and enabling 20-30% premium pricing.

5. Regulatory Alignment: 2025 EU MDR updates mandate compliance for custom devices, with subsidies easing adoption for bio-compatible glass ceramics.

Case studies highlight success: A Warsaw clinic saw 25% revenue growth post-wet milling adoption, while Sofia practices save €25,000 annually on lab fees through in-house glass ceramic processing.

Initial investments (€50,000-€75,000) challenge rural clinics, with ROI extending to 18-24 months without tourism. Maintenance (5-10% downtime) and training (1-2 months) require robust support. Regulatory fines up to €100,000 for non-compliance under MDR emphasize certification needs.

Strategies include leveraging EU NextGenerationEU funds, focusing on urban tourism hubs like Varna, Bulgaria, and using social media for patient targeting. Long-term material studies are needed, but current data supports wet milling's reliability.

By 2030, innovations like AI-assisted designs will reduce processing times by 50%, integrating with 3D printing for hybrid glass ceramic solutions. Regenerative materials and bio-scaffolds will expand applications, with dental tourism's growth amplifying demand in Croatia and Estonia.

In conclusion, the prospects for chairside CAD/CAM same-day restorations with wet milling for glass ceramics in Eastern Europe's small dental clinics are strong, offering 35% ROI in prime scenarios and positioning practices for competitive success. With accelerating growth in Poland, Hungary, Romania, Bulgaria, and beyond, early adopters will thrive through strategic implementation and local optimizations.

Dry & wet milling for zirconia, PMMA, wax with auto tool changer.

learn more

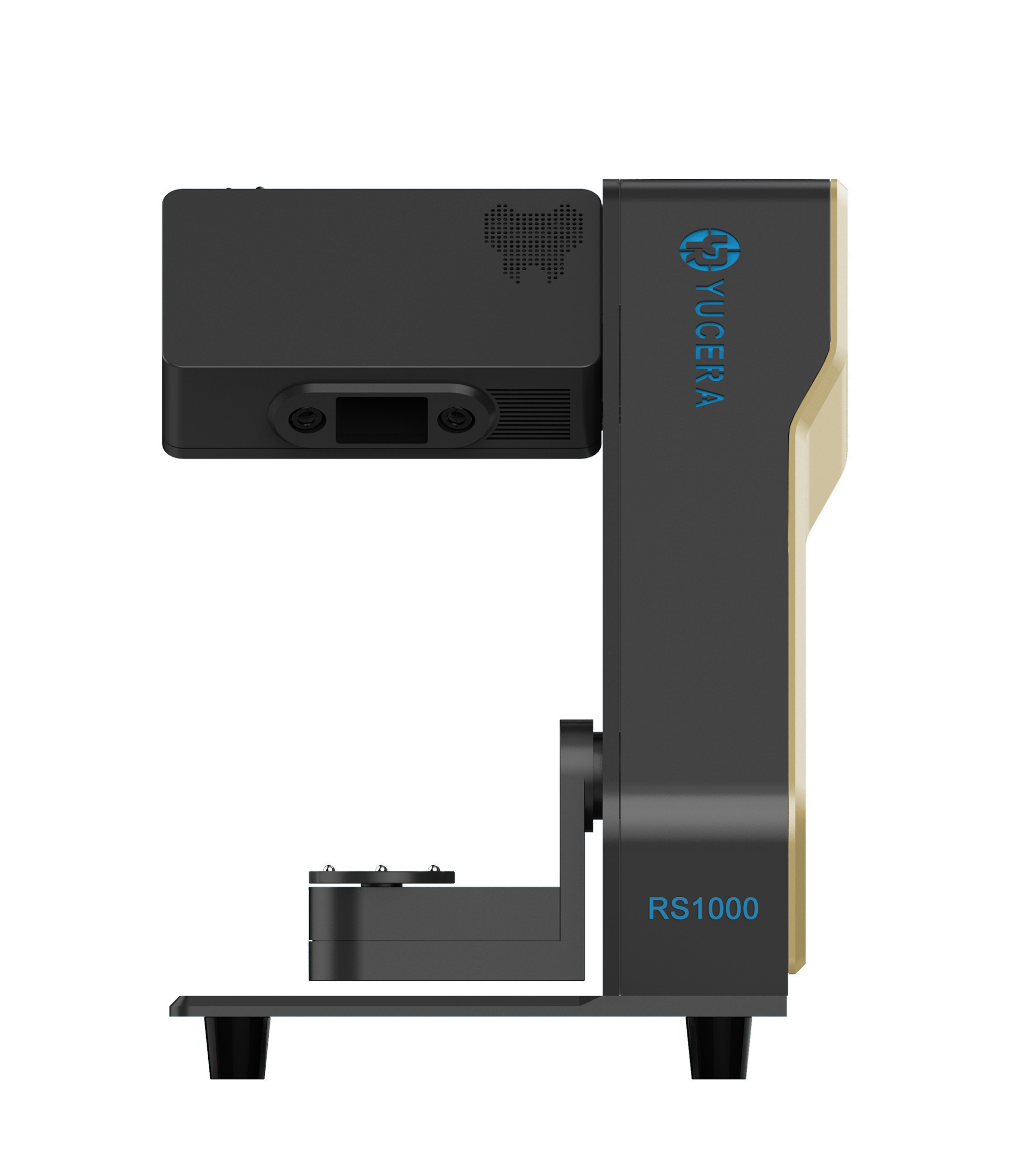

High-precision 3D scanning, AI calibration, full-arch accuracy.

learn more

40-min full sintering with 57% incisal translucency and 1050 MPa strength.

learn more

40-min cycle for 60 crowns, dual-layer crucible and 200°C/min heating.

learn more

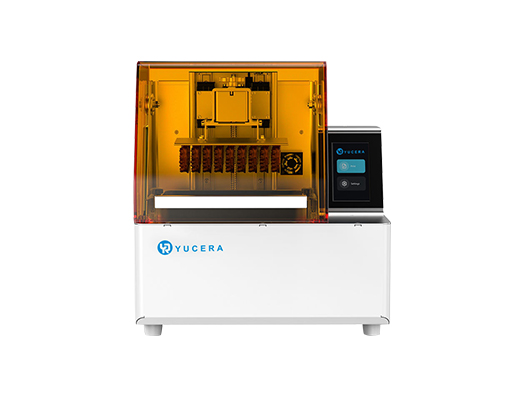

High-speed LCD printer for guides, temporaries, models with 8K resolution.

learn more