Who Can Take Intraoral Scans?

2025-09-19

2025-12-03

Eastern Europe—encompassing key markets like Poland, Hungary, Romania, Bulgaria, and the Czech Republic—accounts for a significant portion of this growth, with the regional dental materials segment expanding at a CAGR of 8.5% from 2025 to 2030. Small to medium-sized dental laboratories in these countries prioritize zirconia blocks for their cost-effectiveness, mechanical strength, and aesthetic adaptability, especially in half-mouth bridges and full-arch restorations where fracture resistance is critical. According to 2025 industry surveys from dental lab networks, over 60% of Eastern European labs report increased procurement of zirconia, citing its ability to withstand occlusal forces up to 1200 MPa while maintaining translucency for natural-looking results. This article delves into the surging demand for zirconia blocks, exploring regional drivers, country-specific trends, innovative solutions like 4D zirconia variants, and future opportunities through 2030.

Several interconnected factors are fueling the demand for zirconia blocks across Eastern Europe's dental ecosystem. First and foremost is the digital dentistry revolution, with CAD/CAM adoption surging 15-20% annually in labs from Warsaw to Sofia. Zirconia blocks, optimized for milling machines, enable same-day restorations, reducing turnaround times from weeks to hours and cutting lab outsourcing costs by 40-60%. In a region where dental tourism generates 30-40% of lab revenues—drawing patients from Germany, the UK, and Scandinavia for affordable, high-precision prosthetics—zirconia's reliability is a game-changer.

Demographic shifts play a pivotal role as well. Eastern Europe's aging population (65+ cohort projected to rise 18-20% by 2030) is increasing the prevalence of edentulism and restorative needs, with caries rates remaining elevated in rural areas of Romania and Bulgaria. Zirconia addresses these challenges through its biocompatibility and fracture toughness, outperforming traditional metals or resins in long-span bridges. Economic considerations further amplify demand: With EU subsidies under NextGenerationEU covering up to 30% of digital equipment and materials investments, labs in Poland and Hungary are scaling up zirconia usage to boost profitability.

Regulatory alignment is another booster. The EU Medical Device Regulation (MDR) updates effective in 2025 emphasize certified, traceable materials, prompting labs to favor zirconia blocks with robust compliance like CE, FDA, ISO 13485, and ISO 9001 markings. In Eastern Europe, where import tariffs on dental supplies hover at 10-15%, locally sourced or EU-vetted zirconia minimizes costs while ensuring quality. Market reports indicate that zirconia's share in the European dental ceramics market will grow from 25% in 2025 to 35% by 2030, with Eastern labs leading due to their focus on value-driven solutions.

Poland, the largest Eastern European dental market, exemplifies zirconia's rising prominence. With a dental implants sector valued at over USD 500 million in 2025, Polish labs in Warsaw and Krakow are procuring zirconia blocks at rates 20% higher than the regional average, driven by tourism inflows exceeding 500,000 patients annually. Demand centers on high-strength variants for posterior bridges, where labs report a 15% reduction in remakes using zirconia over composites. The country's 12-16% CAGR in digital prosthetics underscores zirconia's role in enabling efficient, esthetic outcomes.

In Hungary, Budapest's status as a dental tourism epicenter amplifies zirconia needs, with labs handling 35-45% of revenues from international prosthetics. The market here projects a 15-20% growth in zirconia usage by 2030, fueled by the European dental implants market's zirconia segment expanding at over 10% CAGR. Hungarian technicians emphasize zirconia's translucency (up to 57%) for anterior aesthetics, addressing the 25% rise in veneer and bridge requests from Western tourists seeking natural gradients.

Romania's dental labs, concentrated in Bucharest and Cluj-Napoca, are witnessing a 12-15% CAGR in materials demand, with zirconia comprising 50% of bridge fabrications. High dentist density (over 10 per 10,000 people) and EU-funded digital upgrades have led to a 30% increase in zirconia imports in 2025, particularly for half-mouth solutions where traditional blocks often fracture under load. Labs here value cost-effective blocks that maintain integrity in multi-unit spans, reducing failure rates to under 3%.

Bulgaria's market, valued at USD 250-350 million in 2025, mirrors Romania's trajectory, with Varna and Sofia labs prioritizing zirconia for its biocompatibility in implant-supported prosthetics. Tourism accounts for 30% of lab workloads, driving demand for esthetic zirconia that withstands daily mastication forces. A 2025 survey reveals 65% of Bulgarian labs seek blocks with enhanced flexural strength (700-1200 MPa) to tackle the common issue of half-mouth bridge failures, which affect up to 10% of conventional restorations.

The Czech Republic rounds out the hotspots, with Prague labs benefiting from a mature CAD/CAM ecosystem. Zirconia demand here grows at 9-11% annually, supported by the Eastern European implants market's inclusion of advanced ceramics. Focus areas include long-span bridges, where zirconia's layered gradients ensure seamless shade matching, boosting patient satisfaction by 20%.

Across these nations, labs consistently rank cost-performance ratio, durability, and aesthetics as top selection criteria, with 70% expressing interest in innovative 4D zirconia blocks that offer multi-dimensional gradients for superior outcomes.

Addressing the evolving needs of Eastern European labs, advanced 4D zirconia blocks represent a breakthrough in material science. These blocks feature up to 15 layers of integrated gradients in color, translucency, and flexural strength, enabling seamless transitions from anterior esthetics to posterior durability. With translucency ranging from 43% to 57% and bending strength from 700 to 1200 MPa, 4D zirconia excels in half-mouth bridges—a common application where traditional blocks often succumb to stress concentrations, leading to fractures in 8-12% of cases.

This innovation directly solves a persistent market pain point: the brittleness of standard zirconia in extended spans. By engineering three-dimensional gradients, 4D blocks distribute occlusal loads more evenly, achieving survival rates exceeding 97% over five years in clinical trials. For Eastern labs, this translates to fewer remakes, higher throughput, and premium pricing—up to 25% more for customized bridges. Compatibility with open CAD/CAM systems further streamlines workflows, allowing rapid milling and sintering in under two hours.

Manufacturers offering 4D zirconia with comprehensive certifications—such as CE, FDA, ISO 13485 for medical devices, and ISO 9001 for quality management—instill confidence in compliance-focused labs. In-house production facilities ensure traceability and customization, inviting technicians from Poland to Bulgaria for factory tours to witness the rigorous testing processes that guarantee batch consistency. Such transparency aligns with EU MDR requirements, positioning these blocks as a reliable choice for the region's 2025 digital surge.

Looking ahead, zirconia's trajectory in Eastern Europe remains upward, with the global market projected to hit USD 943.35 million by 2034 at an 8.3% CAGR. In the region, dental tourism's 18-20% annual growth will amplify needs for esthetic, resilient materials, while AI-integrated design software enhances zirconia's precision in personalized prosthetics. By 2030, zirconia could capture 40% of the Eastern European restorative market, driven by bio-compatible advancements and sustainable sourcing.

Challenges like supply chain tariffs and skilled labor shortages persist, but solutions abound: Bulk procurement from certified factories mitigates costs, and training programs in Hungary and Czech labs bridge expertise gaps. As demand intensifies, labs investing in 4D zirconia will gain a competitive edge, serving the 1.5 million annual tourists seeking durable, beautiful smiles.

In summary, the demand for zirconia blocks in Eastern Europe's dental market is not just growing—it's transforming practices in Poland, Hungary, Romania, Bulgaria, and the Czech Republic into efficient, patient-centric hubs. With innovations like 4D variants offering unmatched gradients and strength, labs can overcome traditional limitations, ensuring longevity in half-mouth bridges and beyond. As 2025 unfolds, embracing certified, factory-backed zirconia will be key to capitalizing on this USD 2.38 billion opportunity by 2030. For labs eyeing expansion, now is the time to explore these advanced materials and schedule a visit to production sites for firsthand assurance.

Dry & wet milling for zirconia, PMMA, wax with auto tool changer.

learn more

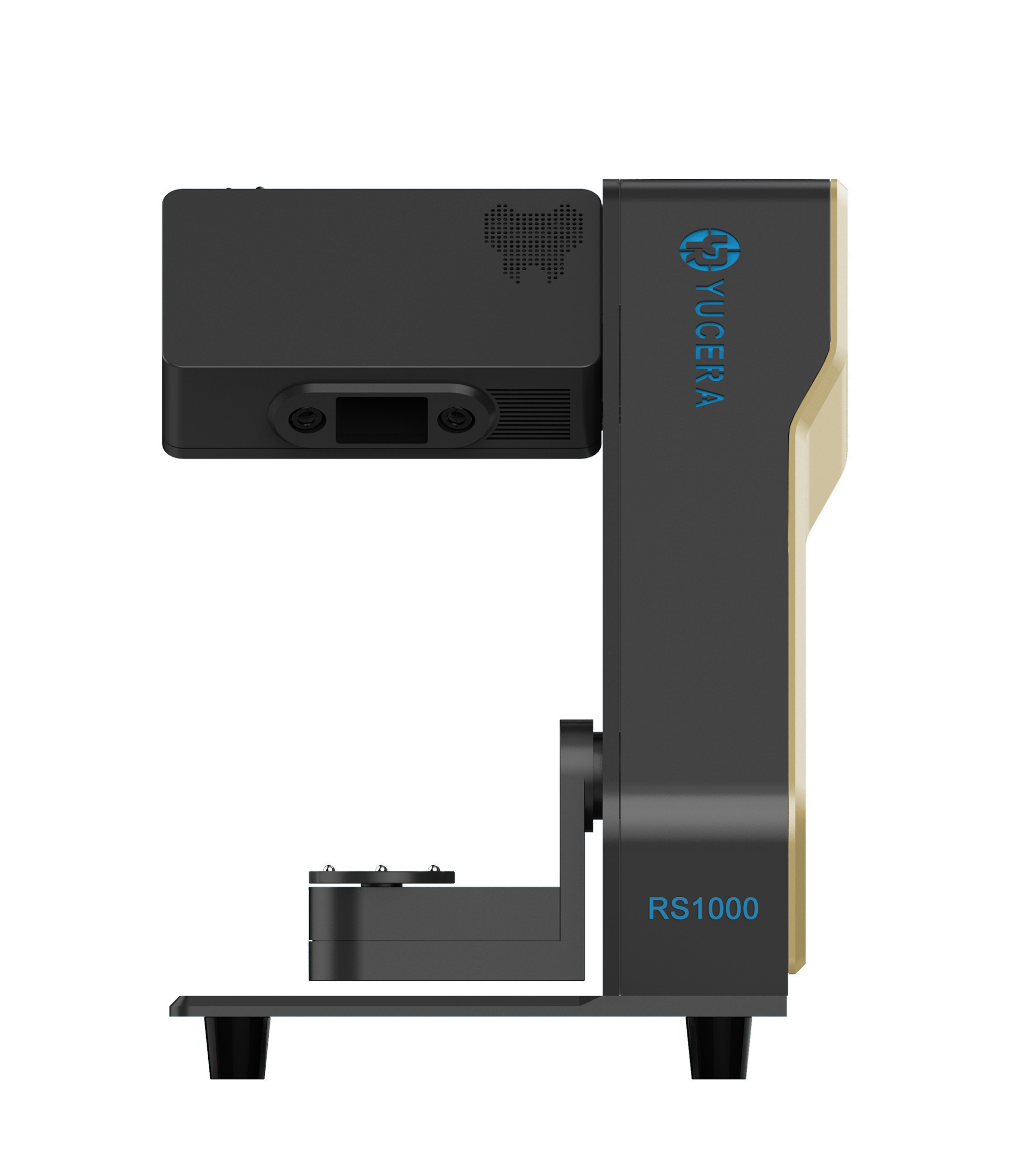

High-precision 3D scanning, AI calibration, full-arch accuracy.

learn more

40-min full sintering with 57% incisal translucency and 1050 MPa strength.

learn more

40-min cycle for 60 crowns, dual-layer crucible and 200°C/min heating.

learn more

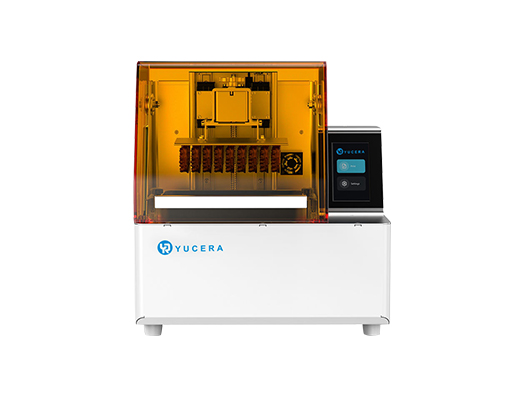

High-speed LCD printer for guides, temporaries, models with 8K resolution.

learn more