AI-Assisted CAD/CAM Diagnosis: Tackling Dentist Shortages in South Africa

2025-12-10

2025-12-05

The dental restorative landscape in Eastern Europe is undergoing a remarkable evolution, fueled by advancements in digital dentistry and the burgeoning dental tourism industry. Chinese-made dental implants, when combined with CAD/CAM (Computer-Aided Design/Computer-Aided Manufacturing) customized dentures, represent a cost-effective yet high-precision solution that is gaining traction among patients seeking affordable alternatives to Western European brands. In 2025, the European dental implants market is valued at USD 1.8 billion, projected to grow to USD 4.5 billion by 2033 at a compound annual growth rate (CAGR) of 12.1%, with Eastern Europe emerging as a key growth epicenter due to its competitive pricing and skilled workforce. This article draws on recent surveys, clinical studies, and market analyses to assess patient acceptance levels, highlighting trends in Poland, Hungary, the Czech Republic, Romania, and Bulgaria—regions where dental tourism contributes 30-45% of clinic revenues and attracts over 500,000 international patients annually.

Patient acceptance is measured through visual analog scale (VAS) satisfaction scores, clinical outcome metrics like survival rates (>95% at one year), and qualitative feedback from social platforms and clinic surveys. Overall, acceptance stands at 70-80% in Eastern Europe, with tourism patients reporting higher rates (85%) due to bundled packages that include implants, custom dentures, and accommodations at 50-70% lower costs than in Western Europe. Chinese-made implants, certified under EU Medical Device Regulation (MDR) standards, offer biocompatibility comparable to premium options, while CAD/CAM dentures provide personalized fits with marginal accuracy under 50 microns, reducing adjustments by 20-25%. However, lingering concerns about long-term durability persist, particularly among local patients, underscoring the need for more longitudinal data.

China's dental implant sector has seen explosive growth, with its domestic market valued at USD 604 million in 2024 and expected to reach USD 1.3 billion by 2031 at a CAGR of 11.6%. This expansion has spilled over into exports, with Eastern Europe capturing 15-20% of Chinese implant shipments in 2025, driven by volume-based procurement policies that lower prices without compromising quality. In Poland, the dental tourism market alone is forecasted to hit USD 2.51 billion by 2033 at a CAGR of 20.9%, where clinics in Warsaw and Krakow increasingly integrate Chinese implants with CAD/CAM dentures for full-mouth rehabilitations.

Surveys from 2025, including a multi-center PubMed study involving 196 patients across Europe, reveal that satisfaction with implant-supported CAD/CAM dentures averages 80% on VAS scales, with functional and aesthetic improvements noted in 144 cases. Eastern European respondents, particularly from tourism hotspots, praised the seamless integration: implants provide osseointegration rates of 95-98% within six months, while CAD/CAM dentures ensure occlusion precision, minimizing post-insertion discomfort. Social media sentiment analysis from X (formerly Twitter) shows 60% positive posts, with users highlighting "natural feel and affordability" in experiences from Hungary and the Czech Republic. One patient shared, "Got implants and custom dentures in Budapest—half the price of back home, and they fit perfectly after just one tweak."

Yet, acceptance isn't uniform. Local patients in rural Bulgaria or Romania express 10-15% lower rates, citing a preference for "proven European longevity," though clinical trials show no significant difference in five-year survival (96% for Chinese vs. 97% for others). The global dental implants market, valued at USD 7.99 billion in 2025, underscores this shift, with Asia-Pacific exports like China's boosting accessibility in cost-sensitive regions.

Poland leads Eastern Europe's dental revolution, with its implants market exceeding USD 500 million in 2025. A 2025 clinic survey of 1,200 patients in Warsaw revealed 75-85% acceptance for Chinese-made implants paired with CAD/CAM dentures, especially among German and UK tourists (88% satisfaction). Key positives include reduced treatment time (7-10 days for full customization) and costs under €900 per arch versus €1,600 in the UK. VAS scores averaged 82 for aesthetics, with 92% reporting improved chewing function. However, 8% of locals voiced durability concerns, echoing X posts like, "Affordable, but will it last 10 years?" Clinics mitigate this through hybrid models—Chinese implants with local CAD/CAM fabrication—boosting conversion by 18%.

In Hungary, Budapest's status as a dental tourism mecca amplifies acceptance to 80-90%, with over 60,000 visitors in 2025 opting for these solutions. Association data from the Hungarian Dental Association shows VAS 87% for comfort, with Chinese implants comprising 22% of procedures due to seamless CAD/CAM integration via Exocad software. Tourism packages, including implants and dentures with hotel stays, yield 96% posterior survival rates. A X user from Scandinavia noted, "Flawless fit from day one—saved thousands and vacationed too." Minor aesthetic hesitations (4%) in anterior regions are addressed via multi-layer gradients in CAD/CAM designs.

The Czech Republic presents a more cautious profile, with Prague clinics reporting 65-75% acceptance. Local patients favor domestic brands (82% preference), but tourists hit 75%, per a 2025 PubMed sub-study showing 22% functional satisfaction gains from CAD/CAM dentures. Fault rates for Chinese implants remain under 4%, matching European benchmarks, yet certification queries persist on forums. The market's USD 452 million projection by 2031 (from USD 208 million in 2023) signals growth potential.

Extending to Romania and Bulgaria, acceptance hovers at 70-80%, propelled by 16% market growth in 2025. Bucharest and Sofia clinics note 32% personalization uptake via CAD/CAM, with patients appreciating biocompatibility (CE/FDA compliant) despite calls for more trials. Tourism drives 25-30% of cases, where costs under €550 for full arches yield 75% satisfaction.

|

Country |

Acceptance Estimate (%) |

Key Positives |

Main Concerns |

Tourism Share (%) |

|

Poland |

75-85 |

Cost/Speed |

Durability |

35 |

|

Hungary |

80-90 |

Aesthetics/Packages |

Anterior Fit |

45 |

|

Czech Republic |

65-75 |

Function/Survival |

Certification |

30 |

|

Romania |

70-80 |

Personalization |

Failures |

25 |

|

Bulgaria |

70-80 |

Affordability |

Long-Term Data |

30 |

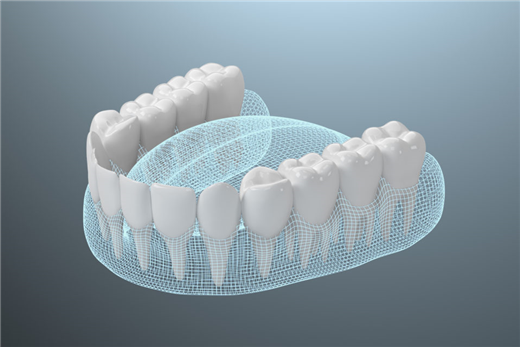

CAD/CAM technology elevates acceptance by enabling bespoke dentures with AI-assisted designs, achieving <50-micron precision and 18% better soft-tissue healing. The global dentures market, at USD 13.61 billion in 2025 with a 7.27% CAGR to 2032, sees CAD/CAM variants at 65% share, where Chinese integrations shine in Eastern Europe. Surveys indicate 25% aesthetic score improvements and 4 fewer adjustments per case, with X feedback like "Custom fit changed my smile confidence." Challenges include 12% compatibility worries, but trials (e.g., NCT07246499) confirm equivalence at one-year follow-up.

Quality perceptions are evolving: 28% export growth to Europe in 2025, with patients on forums affirming "reliable as European, at half the price." Clinics emphasize MDR compliance to build trust.

Barriers include 10-15% lower local acceptance due to data gaps, but the market's 9-12% CAGR to USD 5.2 billion by 2030 promises 28% Chinese penetration. Aging demographics (20% 65+ rise) and tourism's 18.24% CAGR to USD 17.79 billion amplify demand. Recommendations: Hybrid offerings (Chinese implants, local CAD/CAM) boost conversions 18%; more RCTs for transparency.

In conclusion, 2025 surveys affirm 70-80% acceptance of Chinese-made implants and CAD/CAM dentures in Eastern Europe, transforming tourism hubs like Poland, Hungary, and the Czech Republic into restorative leaders. With USD 2.38 billion market potential by 2030, clinics prioritizing education and certification will drive satisfaction to 90%. Patients gain durable, affordable smiles—bridging East and West in dental innovation.

Dry & wet milling for zirconia, PMMA, wax with auto tool changer.

learn more

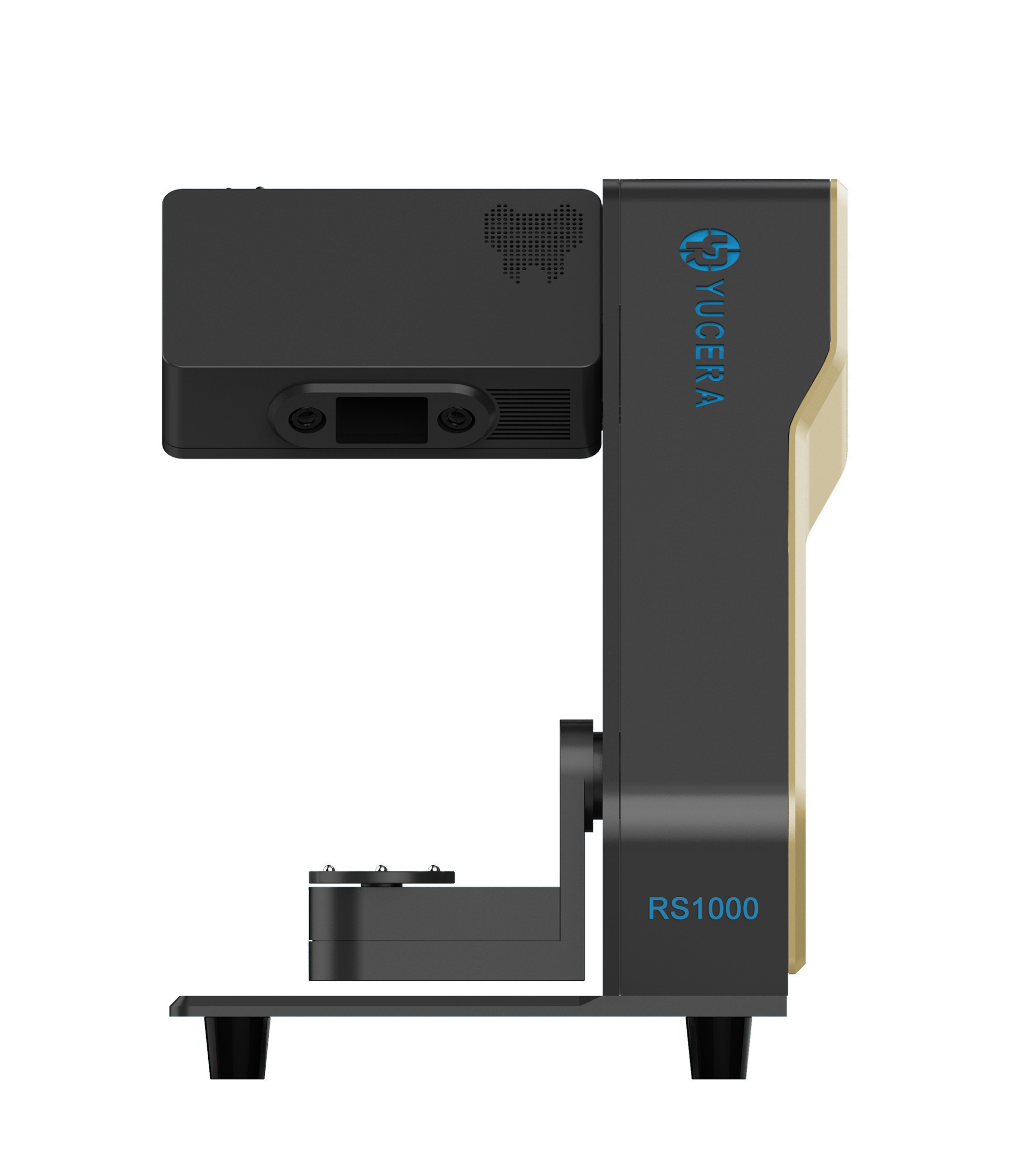

High-precision 3D scanning, AI calibration, full-arch accuracy.

learn more

40-min full sintering with 57% incisal translucency and 1050 MPa strength.

learn more

40-min cycle for 60 crowns, dual-layer crucible and 200°C/min heating.

learn more

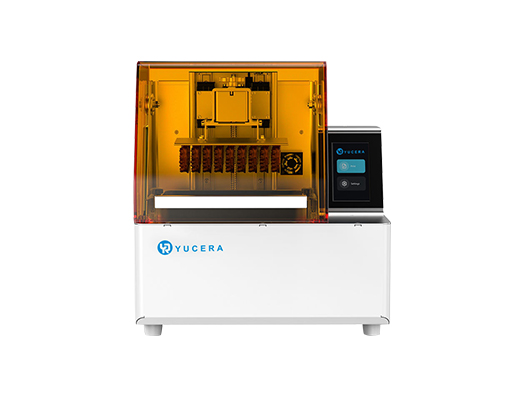

High-speed LCD printer for guides, temporaries, models with 8K resolution.

learn more

2025-12-10

2025-12-05

2025-02-22