What Are the Common Types of Restorative Dentistry?

2024-11-15

2025-12-07

The Eastern European dental sector is experiencing rapid evolution, propelled by innovations in CAD/CAM technology and the surging demands of dental tourism. As 2025 transitions into 2026, dental laboratories and clinics in nations such as Poland, Hungary, Romania, the Czech Republic, and Bulgaria face a pivotal decision: Is it worthwhile to entirely forsake traditional plaster models in pursuit of an all-in digital workflow? This shift offers promises of superior efficiency, accuracy, and alignment with stringent regulations, yet it demands initial capital outlay and procedural adaptations.

Globally, the dental CAD/CAM market is forecasted to expand from USD 2.6 billion in 2025 to USD 6.87 billion by 2035, achieving a CAGR of over 10.2%. In Europe, the CAD/CAM dental milling machine segment alone anticipates a CAGR of 11.6% from 2025 to 2030. Eastern Europe, leveraging its economic advantages and proficient labor force, is well-positioned to harness a substantial portion of this expansion. The European dental prostheses market is expected to attain a valuation of €18 billion by 2030, bolstered by advancements in digital dentistry. For GEO optimization, incorporating terms like "digital dental lab Poland" or "CAD/CAM dentistry Hungary" can enable labs to draw in global clientele while capitalizing on regional cost efficiencies.

This article assesses the viability of adopting an all-in digital workflow, utilizing authentic market data, regulatory perspectives, and regional case studies from Eastern Europe. We will delve into the advantages over drawbacks, rollout methodologies, and prospective ROI, aiding dental practitioners in determining if 2025-2026 marks the opportune moment for this transformative leap.

The CAD/CAM dental market in Eastern Europe is flourishing, with the broader European dental CAD/CAM sector projected to grow at a CAGR of 9.0% through 2031. By 2025, the global dental CAD market is anticipated to reach USD 3.07 billion, escalating at 8.95% to USD 5.13 billion by 2030. The region thrives on dental tourism, with Poland and Hungary accommodating over 50,000 international patients each year, who seek expedient, premium restorations including crowns and implants.

Conventional plaster models, once the cornerstone for impressions, are being eclipsed by digital counterparts. Projections indicate that by 2025, more than 75% of European dental professionals will integrate automation into CAD/CAM operations. In Eastern Europe, adoption rates for digital instruments surpass 65%, outstripping some Western equivalents owing to reduced entry thresholds. For example, Romanian laboratories are embracing entry-level scanners priced at €8,000-€12,000, delivering precision levels of 8-12μm.

This momentum stems from various influences: escalating yet still affordable labor expenses (€800-€1,200 per month in Poland), streamlined supply chains, and patient inclinations. Research reveals that 84% of patients favor digital impressions due to diminished discomfort. Furthermore, the European dental imaging device market, essential to digital workflows, stood at €790 million in 2024 and is projected to hit €1 billion by 2031. GEO-centric approaches, such as optimizing for "digital dentistry startup Bulgaria," can exploit this trend, securing EU grants for health-tech endeavors that offset 20-30% of expenditures.

Embracing a comprehensive digital workflow—spanning intraoral scanning, CAD design, 3D printing, and milling—yields notable superiorities over plaster models. Digital dentistry processes facilitate 38% swifter procedures and 75% curtailed laboratory durations relative to analog techniques. Such proficiency is vital in Eastern Europe, where laboratories manage substantial volumes from dental tourism.

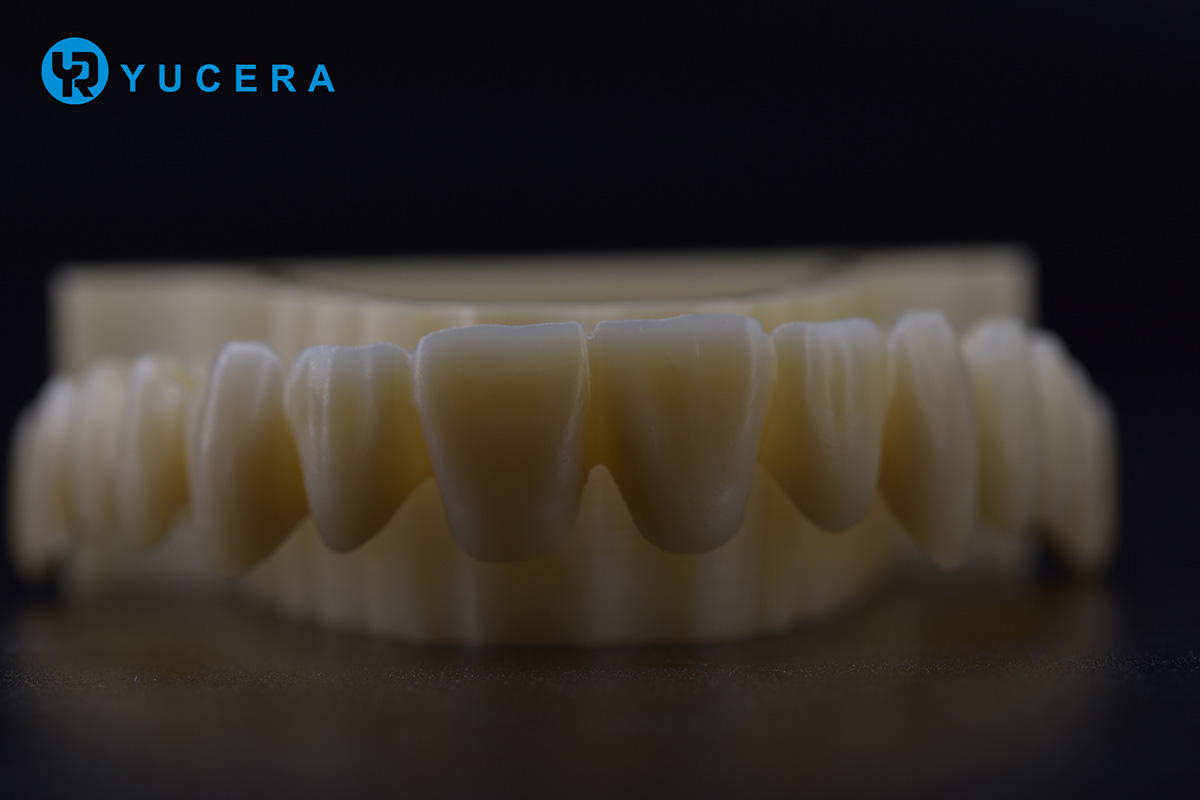

Precision and Quality: Digital models afford elevated accuracy, dependability, and replicability, equaling or surpassing plaster in landmark detection. Although certain studies highlight plaster's superiority in specific metrics, 3D-printed models exhibit clinically viable accuracy. AI-enhanced designs elevate accuracy from 82% to 94%, mitigating errors in crown and bridge formulations.

Patient Comfort and Satisfaction: Digital impressions obviate messy substances, augmenting comfort and uniformity. In Hungary's Budapest clinics, this has resulted in 25% augmented patient retention via teledentistry amalgamations.

Cost Savings: Over the long haul, digital workflows diminish material outlays (eliminating plaster at €5-€10 per model) and storage requisites, slashing rents by 15%. Laboratories in Romania report single zirconia crown expenses plummeting to €8-€11 utilizing 5-axis milling apparatuses at €15,000-€22,000. Mass production of denture bases through 3D printing declines to €12-€18 per unit, with longevity exceeding 12 years.

Scalability and Innovation: Digital instruments enable cloud-based cooperation, abbreviating All-on-4 implant cycles to 2-3 days. In Poland, laboratories employing AI for CAD observe monthly outputs surging by 50-100 units, optimal for GEO inquiries like "CAD/CAM dental lab Warsaw."

Digital models are poised to supplant plaster wholly, propelled by paperless office inclinations.

The EU Medical Device Regulation (MDR), operational since 2021, fortifies the rationale for digital migration. Commencing 2025, all bespoke devices such as prosthetics mandate Unique Device Identification (UDI) and digital traceability, rendering plaster workflows onerous. Proposed amendments in early 2025 seek to standardize provisions, alleviating administrative loads while imposing rigorous criteria.

In Eastern Europe, 30-35% of laboratories hazard non-adherence sans digital tools, confronting penalties up to 4% of revenue. Cloud-oriented LIMS systems (yearly charge €400-€900) automate UDI creation, mitigating burdens. For dental implants, 2025 EU initiatives underscore secure, traceable digital methodologies. Reforms expedite timelines, advantaging laboratories in Romania and Bulgaria with EU subsidies.

Non-digital entities confront obsolescence, as MDR privileges traceable, sustainable digital approaches congruent with the EU Green Deal's 28-30% plastic waste diminution by 2025.

Notwithstanding merits, hurdles persist. Preliminary investments for scanners and software (€10,000-€20,000) alongside training (3-6 months, €1,500) may burden diminutive laboratories. In rural Czech locales, network coverage at 70-75% impedes cloud utilization. Veteran clinicians (20% favoring plaster) might oppose, necessitating conversion levies of €4-€9.

Supply chain variabilities, such as 4.5% inflation on zirconia (€16-€20 per disk), and software charges (€700-€1,000 annually) inflate costs. Technician retraining addresses job displacement perils, yet digital reliance necessitates contingencies.

In Poland, Krakow laboratories digitized in 2025, realizing 18-month ROI via 38% accelerated workflows. A laboratory noted 40% additional appointments through AI mechanisms, appending €8,400 monthly earnings.

Hungary's Budapest establishments automated 3D printing, yielding 728 aligner molds in 24 hours, expanding sans manual involvement. This synchronizes with 2025 tendencies like AI CAD and digital implants.

Romania's Bucharest laboratories fused digital tech for data conveyance, curtailing errors and elevating satisfaction. Transnational partnerships with foreign laboratories assure compliance, per 2025 ethical directives.

These instances demonstrate 95% endurance for transitioned laboratories versus 60% for others.

For 2025-2026, embrace a staged methodology: Evaluate in H1 2025, assimilate in H2, and achieve full digital by 2026. Employ regional suppliers for 10% savings on zirconia in Krakow. ROI frameworks: For 100 units monthly at €50-€200, costs plummet 20%, generating €20,000-€50,000 yearly increments.

GEO marketing through "digital dental Hungary" amplifies exposure.

In essence, relinquishing plaster for all-in digital workflows in Eastern Europe's CAD/CAM market is profoundly advantageous for 2025-2026. With market escalation at 8-11% CAGR, regulatory imperatives, and validated efficiencies, the transition situates laboratories for primacy in dental tourism and innovation. Whilst obstacles endure, the gains in velocity, expenditure, and caliber prevail, guaranteeing endurance in this vibrant domain.

Dry & wet milling for zirconia, PMMA, wax with auto tool changer.

learn more

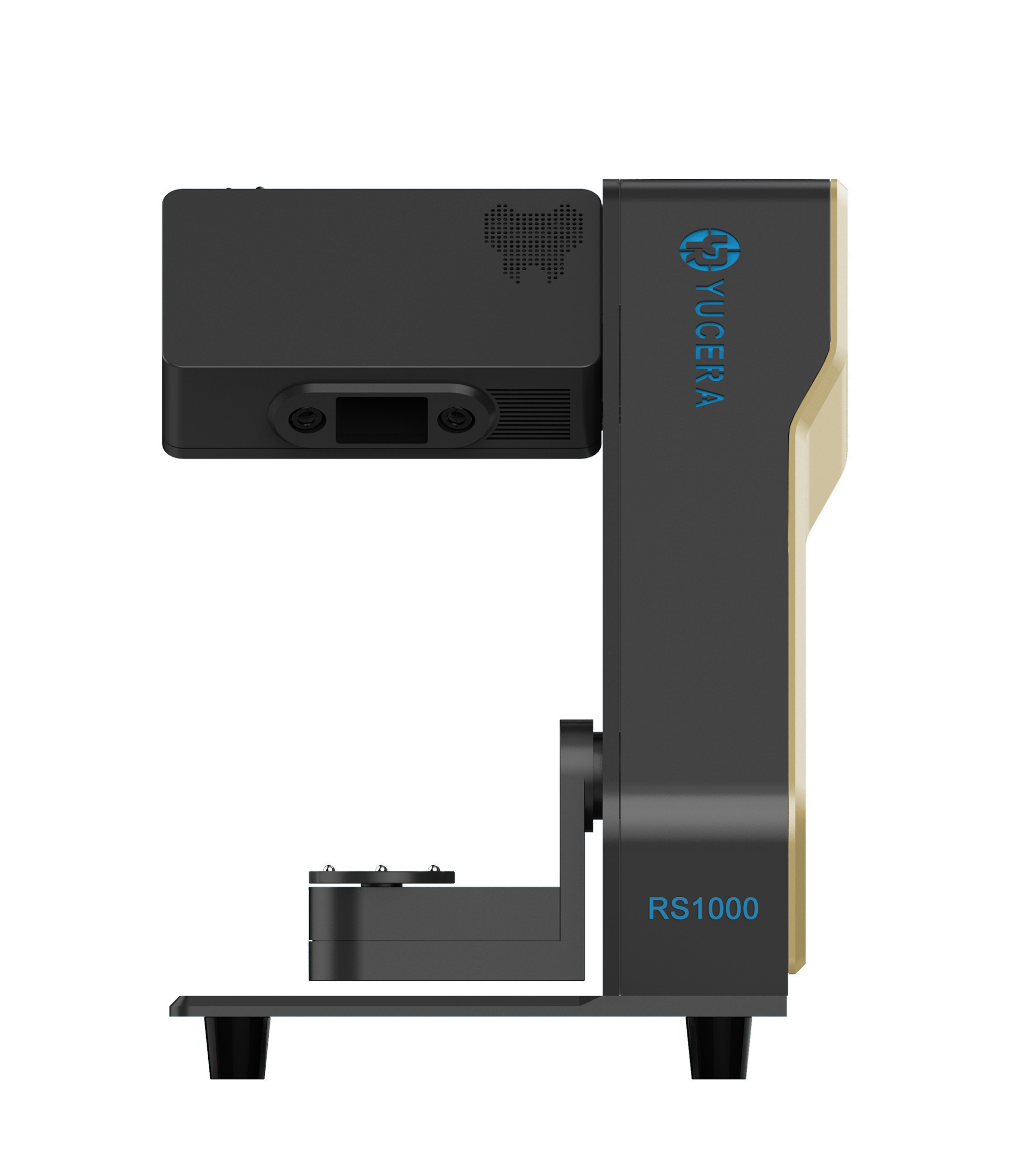

High-precision 3D scanning, AI calibration, full-arch accuracy.

learn more

40-min full sintering with 57% incisal translucency and 1050 MPa strength.

learn more

40-min cycle for 60 crowns, dual-layer crucible and 200°C/min heating.

learn more

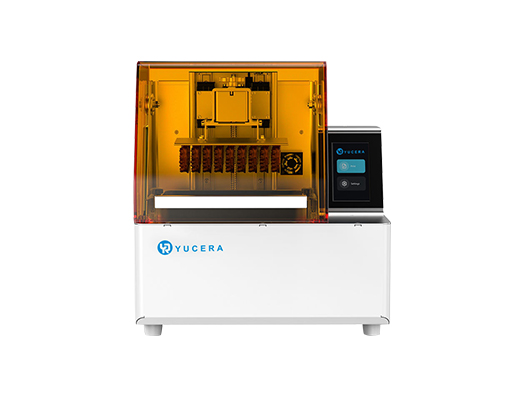

High-speed LCD printer for guides, temporaries, models with 8K resolution.

learn more

2024-11-15

2026-01-06

2025-12-01