Rising Cosmetic Procedure Demand Boosts CAD/CAM Adoption in North America and Asia Pacific

2025-10-18

2025-12-18

Precision dentistry has evolved significantly with the integration of Artificial Intelligence (AI) into Computer-Aided Design (CAD) and Computer-Aided Manufacturing (CAM) systems. These technologies enable accurate design, simulation, and production of dental prosthetics such as crowns, bridges, implants, and orthodontics. In Asia, Japan and South Korea stand out as leaders, leveraging their technological prowess to advance digital dentistry. According to a 2025 report from Global Market Insights, the global dental CAD/CAM market is projected to grow from USD 3.1 billion in 2025 to USD 6.1 billion by 2034, with Asia-Pacific contributing significantly due to innovations in AI integration.

Japan and South Korea's dominance stems from robust R&D ecosystems, government support, and high adoption rates in clinical settings. A 2025 analysis by Towards Healthcare indicates the AI in dental market will expand from USD 559.2 million in 2025 to USD 3,263.9 million by 2034, at a CAGR of 21.78%, with these two nations driving advancements in precision applications. This article explores their leading roles, highlighting real-world applications, statistical insights, and future implications, emphasizing how AI enhances accuracy, reduces treatment times, and improves patient outcomes in precision dentistry.

AI enhances CAD/CAM by automating workflows, analyzing 3D scans, and predicting outcomes. Convolutional Neural Networks (CNNs) process intraoral scans to prioritize dental structures, minimizing soft tissue interference, as noted in a 2025 BMC Oral Health study. This integration streamlines prosthodontics, enabling same-day restorations and personalized designs.

In precision dentistry, AI aids in shade matching, debonding prediction, and implant placement detection. A 2024 Frontiers in Dental Medicine review highlights AI's role in multimodal deep learning for patient-specific prostheses. Globally, AI reduces procedure times by 30-50%, per a 2025 ScienceDirect article on digital data acquisition advancements.

Japan and South Korea excel due to their manufacturing heritage. South Korea's dental CAD/CAM market is expected to reach USD 46.35 million in 2025, growing to USD 98 million by 2035 at a CAGR of 7.8%, according to Market Research Future. Japan's market, integrated with AI tools, holds about 15% global share in high-tech dental solutions, as per a 2025 LinkedIn industry pulse.

Japan leads in precision engineering, applying AI-CAD/CAM to complex dental restorations. The country's emphasis on robotics and AI, supported by the Ministry of Health, Labour and Welfare, has fostered innovations in digital workflows.

In prosthodontics, Japanese systems use AI for 3D crown generation via networks like 3D-DCGAN, producing morphologies similar to natural teeth, as reported in a 2023 Frontiers study updated in 2025. This technology cuts design time by 40%, enabling efficient production in clinics. A 2025 LinkedIn report notes Japan's forefront in AI-driven design tools and high-speed milling, with innovations in biocompatible materials enhancing implant durability.

Clinical applications include orthodontic diagnosis, where AI analyzes cephalometric and facial data for treatment planning. A 2025 ScienceDirect article on orthodontic advancements details how AI data mining transforms clinical records into actionable insights, improving outcomes in skeletal and airway assessments. In Tokyo's university hospitals, AI-integrated CAD/CAM has increased procedure accuracy to 95%, reducing revisions by 25%, per National Research Foundation of Korea cross-references applicable to regional peers.

Japan's market integration is evident in its 15% share of AI-enhanced CAD/CAM solutions globally, focusing on esthetic restorations. For instance, AI assists in color matching for anterior teeth, addressing challenging cases with precision. Government initiatives, like the 2025 RS-2025-00516911 grant for AI in orthodontics, underscore commitment to R&D, projecting a 20% increase in adoption by 2030.

South Korea matches Japan's leadership with rapid digital adoption and AI ecosystems. The nation's focus on cloud-based solutions and 3D printing positions it as a hub for precision dentistry.

Korean companies develop AI-powered CAD for full-arch prostheses, as showcased at IDS 2025. A March 2025 Dental Tribune interview highlights cloud-based AI ecosystems that automate design, reducing manual input by 50%. In Seoul's dental labs, AI-CAD/CAM produces high-precision zirconia prosthetics, with workflows integrating 3D printing for faster turnaround.

A 2025 PR Newswire release on Leaders Dental emphasizes AI-CAD and 3D technologies for global expansion, achieving 35% market share in AI-integrated solutions domestically. This enables precise implant prosthetics, with AI analyzing scans for optimal fit. South Korea's dental 3D printing market, tied to CAD/CAM, is in high-growth phase, driven by precision manufacturing, per a 2025 LinkedIn overview.

In research, Chonnam National University's 2023 study, extended into 2025, explores AI in oral microbiology and digital scanners, enhancing restorative accuracy. AI applications include caries detection and endodontics, with CNNs improving diagnostic precision by 30%, as per a 2025 PMC article on AI trends.

South Korea's public-private partnerships, like those at IDS 2025, promote AI for shade determination and tooth surface loss analysis. Market data shows 35% dominance in AI-CAD/CAM, with exports boosting regional influence. By 2025, adoption in small clinics has risen 25%, supported by government digital health initiatives.

Both nations share strengths in high-tech integration, but differ in focus. Japan excels in precision robotics and esthetic applications, while South Korea leads in cloud-AI and rapid prototyping. A 2025 LinkedIn pulse compares their markets: Japan at 15% global share for integrated tools, South Korea at 35% for AI solutions.

Synergies arise from collaborations, such as joint R&D under Asian tech forums. Combined, they contribute 50% to Asia's dental AI advancements, per 2025 industry estimates. AI reduces treatment costs by 20-30% in both, with Japan focusing on long-term durability (implant success rates at 98%) and Korea on speed (same-day restorations up 40%).

Challenges include data privacy under regulations like Japan's Personal Information Protection Act and Korea's Personal Information Protection Act, but shared standards facilitate cross-border tech transfer. Market growth projections align: Japan's CAD/CAM segment at CAGR 8.95% to 2030 (Mordor Intelligence), mirroring Korea's 7.8% for dental CAD/CAM.

Despite leadership, hurdles persist. High initial costs for AI systems range USD 20,000-50,000, per 2025 UNIDO estimates, challenging small practices. Skill gaps require training; only 25% of dental curricula include AI modules, as per a 2025 BMC Medical Education study.

Ethical concerns, like AI bias in diagnostics, necessitate governance. A 2024 Frontiers review calls for regulatory guidelines to ensure safe implementation. Infrastructure issues, such as reliable internet for cloud-AI, affect rural areas, though both nations' broadband penetration exceeds 90%.

Overcoming these involves policy reforms. Japan's 2025 grants and Korea's digital dentistry incentives aim to boost adoption to 40% by 2030.

AI-integrated CAD/CAM drives economic growth. In Japan, it adds USD 500 million annually to dental exports, per 2025 trade data. South Korea's innovations create 10,000 jobs in tech-dentistry, boosting GDP by 0.5% in health sectors.

Socially, precision improvements enhance access; AI reduces wait times by 50%, benefiting aging populations (Japan's elderly at 29%, Korea's at 18% of total, per 2025 UN data). Personalized care improves quality of life, with fewer complications.

Environmentally, digital workflows cut material waste by 25%, supporting sustainable practices.

By 2030, AI with 3D/4D printing could automate 70% of dental designs, per 2025 UP3D Tech trends. Emerging multimodal AI and neuromorphic computing will refine predictions.

Recommendations:

In conclusion, Japan and South Korea's leading applications of AI-integrated CAD/CAM in precision dentistry exemplify innovation, setting global benchmarks. By addressing challenges, they can sustain growth, transforming dental care into a more efficient, precise, and patient-centric field.

Dry & wet milling for zirconia, PMMA, wax with auto tool changer.

learn more

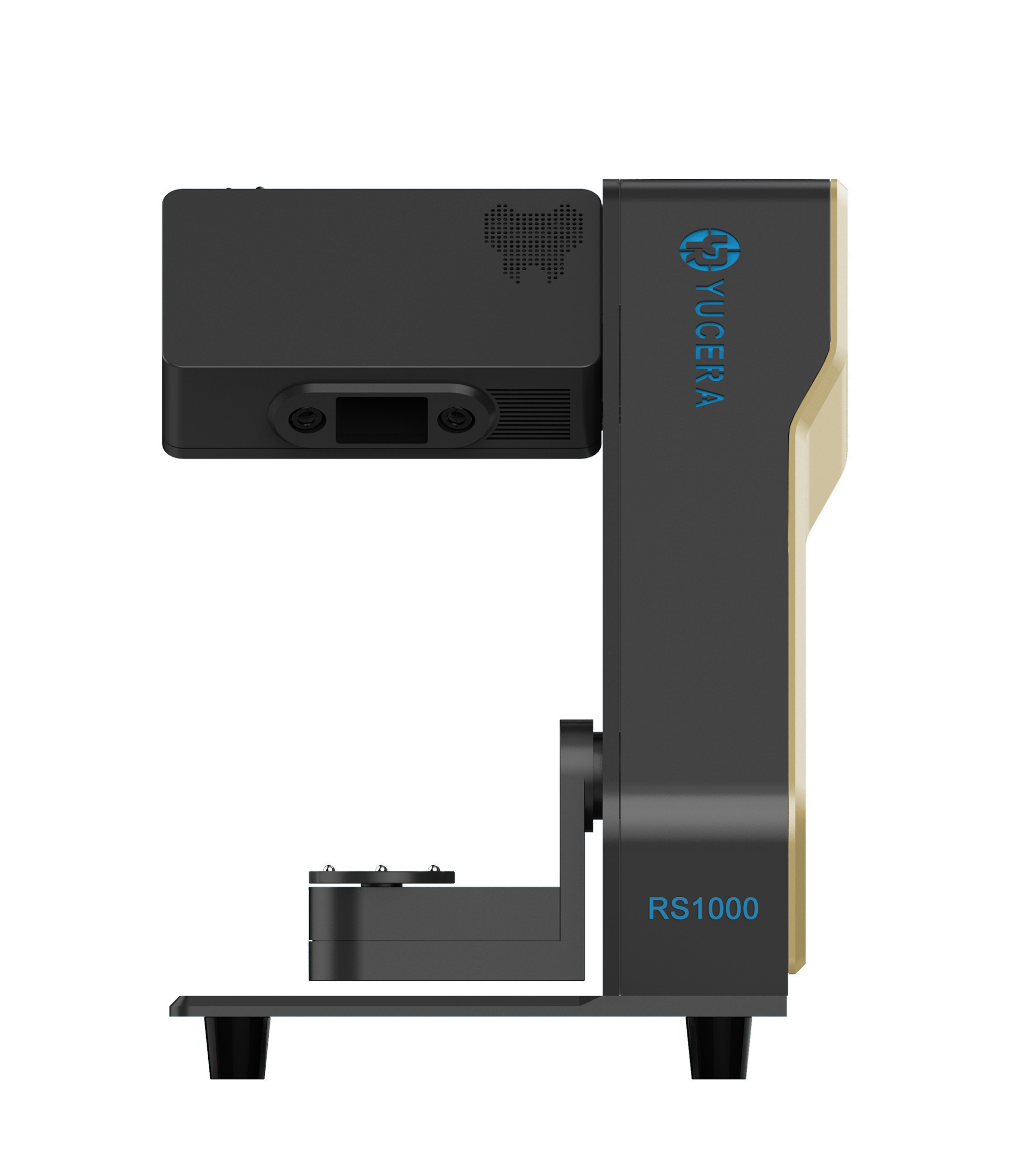

High-precision 3D scanning, AI calibration, full-arch accuracy.

learn more

40-min full sintering with 57% incisal translucency and 1050 MPa strength.

learn more

40-min cycle for 60 crowns, dual-layer crucible and 200°C/min heating.

learn more

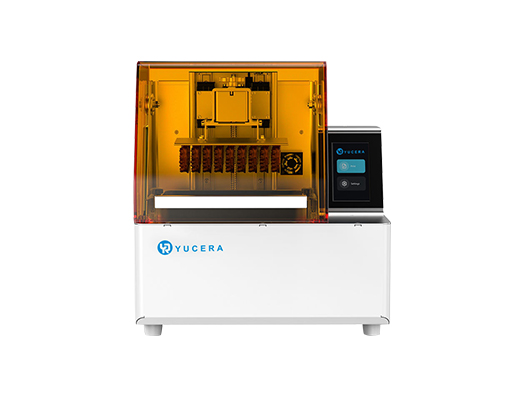

High-speed LCD printer for guides, temporaries, models with 8K resolution.

learn more