Advancements in Dental Sintering Furnaces: Key Trends, Innovations, and Best Practices for 2025

2025-12-01

2025-12-16

Computer-Aided Design (CAD) and Computer-Aided Manufacturing (CAM) technologies have revolutionized global manufacturing by enabling precise design, simulation, and production processes. In Africa, where industrial growth is accelerating, CAD/CAM systems play a pivotal role in sectors like automotive, aerospace, textiles, and medical devices. However, the continent faces significant challenges due to heavy reliance on imports for CAD/CAM hardware, software, and raw materials. According to the African Development Bank (AfDB), Africa's manufacturing sector contributes only about 10-15% to GDP in most countries, with import dependency exacerbating vulnerabilities to global supply disruptions, currency fluctuations, and trade barriers.

This article examines the import dependency challenges in African CAD/CAM supply chains and proposes optimization strategies. By focusing on local capacity building, digital integration, and sustainable practices, African nations can reduce risks and foster economic self-reliance. Data from sources like the World Bank and United Nations Industrial Development Organization (UNIDO) highlight that optimizing these chains could boost manufacturing output by up to 20-30% in key regions like East and West Africa.

Africa's CAD/CAM ecosystem is heavily import-dependent. Over 80% of CAD/CAM software and hardware, including CNC machines, 3D printers, and design tools, are sourced from Europe, Asia, and North America, as per UNIDO reports from 2023. This dependency stems from limited local production capabilities, skilled labor shortages, and inadequate infrastructure. For instance, in sub-Saharan Africa, import tariffs and logistics costs inflate prices by 30-50%, making CAD/CAM adoption expensive for small and medium enterprises (SMEs).

Global events, such as the COVID-19 pandemic and geopolitical tensions, have amplified these issues. Supply chain disruptions led to delays of up to six months for CAD/CAM equipment imports, according to a 2022 World Trade Organization (WTO) study. In countries like Nigeria and Kenya, where manufacturing relies on imported components, production halts have resulted in economic losses estimated at $5-10 billion annually across the continent.

Currency volatility further compounds the problem. The depreciation of currencies like the South African Rand and Egyptian Pound against the US Dollar increases import costs, straining budgets. Additionally, poor port infrastructure in ports like Durban and Mombasa causes bottlenecks, with average clearance times exceeding 10 days, per AfDB logistics performance indices.

Environmental factors also play a role. High carbon footprints from long-distance shipping contribute to sustainability concerns, with African imports accounting for significant emissions under global trade. A 2024 report by the International Energy Agency (IEA) notes that optimizing local supply chains could reduce transport-related emissions by 15-25% in manufacturing hubs.

To address these challenges, African stakeholders must adopt multifaceted optimization strategies. These include localizing production, enhancing digital infrastructure, fostering partnerships, and leveraging policy frameworks.

Localizing CAD/CAM Production and Sourcing

Promoting local manufacturing of CAD/CAM components is essential. Initiatives like establishing industrial parks in Ethiopia and Rwanda have shown promise. Ethiopia's Hawassa Industrial Park, operational since 2017, has attracted investments in textile CAD/CAM systems, reducing import needs by 20%, according to government data.

Encouraging SMEs to use open-source CAD/CAM software, such as FreeCAD or LibreCAD, can lower costs. Training programs funded by organizations like the African Union (AU) aim to upskill 1 million workers by 2030, focusing on local assembly of CNC machines using regionally sourced materials like steel from South Africa.

Intra-African trade under the African Continental Free Trade Area (AfCFTA), launched in 2021, offers opportunities. By 2025, AfCFTA is projected to increase intra-African trade by 52%, per AU estimates, allowing countries like Morocco to supply CAD/CAM parts to neighbors, reducing external dependency.

Digital Integration and Technology Adoption

Integrating Industry 4.0 technologies can streamline supply chains. Cloud-based CAD/CAM platforms enable real-time collaboration, reducing lead times by 40%, as seen in pilot projects in Tunisia's automotive sector, per a 2023 UNIDO case study.

Blockchain for supply chain traceability ensures transparency in imports, minimizing fraud and delays. In Ghana, blockchain pilots have cut customs processing times by 50%. AI-driven predictive analytics can forecast disruptions; for example, tools analyzing global shipping data help anticipate delays, with accuracy rates of 85% in simulations.

Investing in broadband infrastructure is crucial. The World Bank's Digital Economy for Africa (DE4A) initiative targets connecting 80% of Africans by 2030, facilitating CAD/CAM data sharing and remote maintenance.

Building Resilient Infrastructure and Logistics

Upgrading ports and transportation networks is vital. Investments in rail links, like Kenya's Standard Gauge Railway, have reduced freight times from Mombasa to Nairobi by 70%, aiding CAD/CAM equipment delivery.

Warehousing improvements, including automated storage systems, can buffer against import volatility. In Egypt, Suez Canal expansions have enhanced throughput, supporting manufacturing clusters in the Nile Delta.

Sustainable energy sources, such as solar-powered factories in Namibia, ensure uninterrupted CAD/CAM operations, countering power outages that affect 60% of African firms, per World Bank surveys.

Policy and Regulatory Reforms

Governments must incentivize optimization through tax breaks and subsidies. South Africa's Manufacturing Competitiveness Enhancement Programme offers grants for CAD/CAM upgrades, leading to a 15% productivity increase in participating firms.

Harmonizing standards across Africa, via AU guidelines, facilitates cross-border trade. Intellectual property protections encourage local innovation, with patent filings in CAD/CAM rising 25% in 2022-2024, according to the World Intellectual Property Organization (WIPO).

Public-private partnerships (PPPs) are key. Collaborations with international development agencies have funded CAD/CAM training centers in 15 countries, training over 50,000 technicians since 2020.

Several African nations provide models for success.

These cases demonstrate that targeted investments yield tangible results, with optimized chains contributing to GDP growth rates of 5-7% in these sectors.

Optimizing CAD/CAM supply chains can drive broader benefits. Economically, it could add $100-150 billion to Africa's GDP by 2030, per AfDB projections, through increased exports and job creation. Socially, it empowers youth and women; programs in Uganda have trained 5,000 women in CAD/CAM skills, enhancing gender inclusion.

Environmentally, local sourcing reduces waste and emissions. Recycling initiatives in e-waste hubs like Agbogbloshie, Ghana, supply materials for CAD/CAM hardware, promoting circular economies.

However, challenges remain, including funding gaps and skill mismatches. Addressing these requires sustained investment, estimated at $50 billion annually for infrastructure, per UNIDO.

Looking ahead, emerging technologies like 5G and additive manufacturing will further optimize chains. By 2030, 3D printing could localize 50% of CAD/CAM production in Africa, reducing imports significantly.

Recommendations include:

In conclusion, while import dependency poses hurdles, strategic optimization of African CAD/CAM supply chains offers a pathway to resilience and growth. By embracing localization, digital tools, and collaborative frameworks, Africa can transform challenges into opportunities, fostering a robust manufacturing future.

Dry & wet milling for zirconia, PMMA, wax with auto tool changer.

learn more

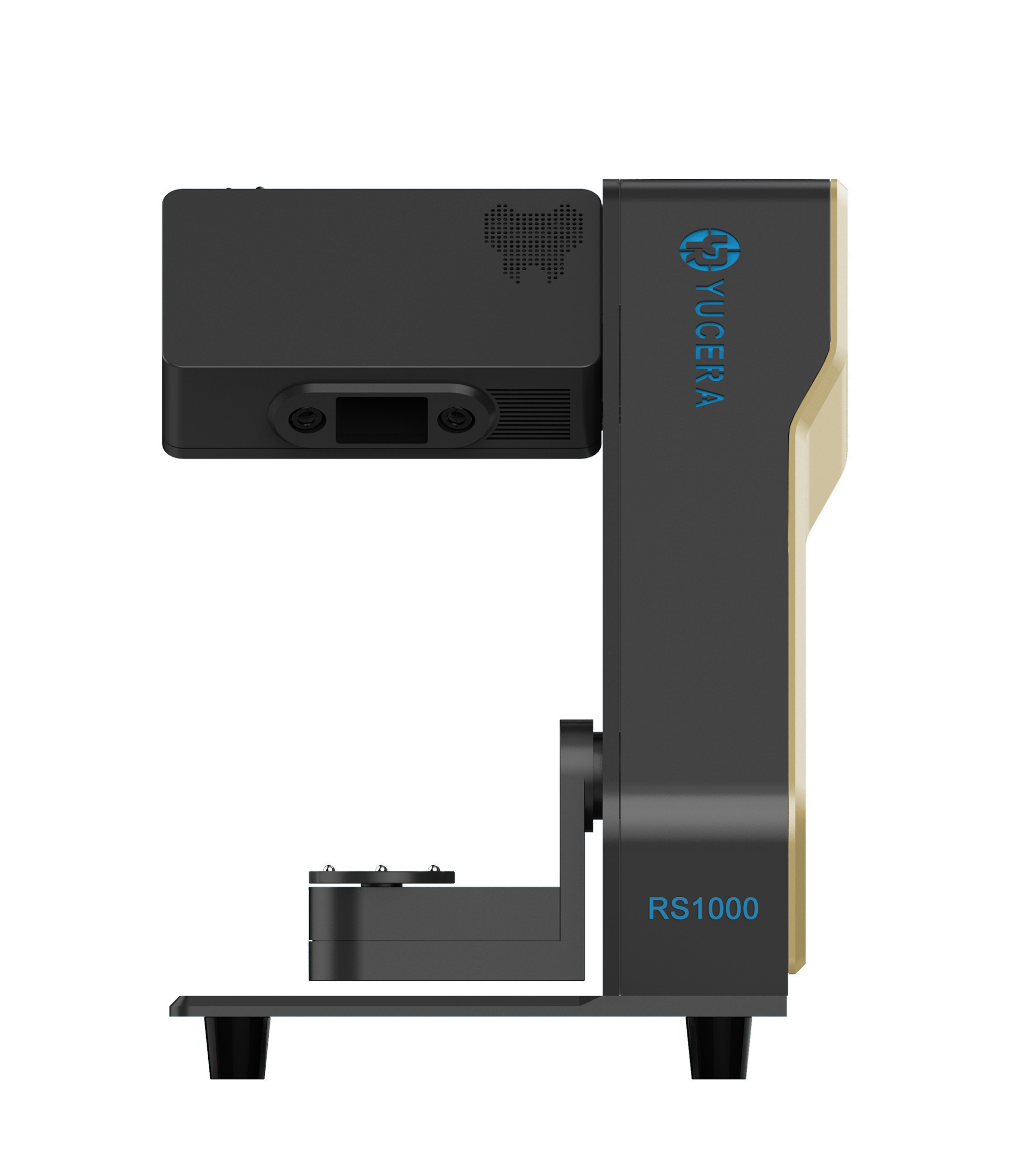

High-precision 3D scanning, AI calibration, full-arch accuracy.

learn more

40-min full sintering with 57% incisal translucency and 1050 MPa strength.

learn more

40-min cycle for 60 crowns, dual-layer crucible and 200°C/min heating.

learn more

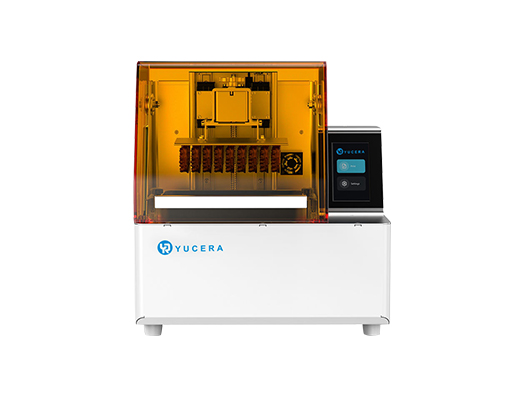

High-speed LCD printer for guides, temporaries, models with 8K resolution.

learn more