What is a zirconia all-ceramic dental crown?

2024-09-19

2025-12-22

In 2025, the dental CAD/CAM market continues its robust expansion, driven by technological advancements and increasing adoption of digital workflows. The global dental CAD/CAM market is projected to reach approximately $2.4 billion in 2025, with forecasts indicating growth to $4.61 billion by 2032 at a compound annual growth rate (CAGR) of 9.8%. This surge is particularly evident in regions like the United States, where chairside systems are widely integrated, Europe with its emphasis on precision diagnostics, and Asia, including emerging markets in China and India, where affordability and accessibility fuel demand.

At the heart of this market lies the intraoral scanner (IOS), a pivotal tool that captures high-resolution 3D images of the oral cavity, replacing traditional impressions. Dentists worldwide, from bustling clinics in New York to specialized practices in London and Shanghai, prioritize IOS devices that enhance efficiency, accuracy, and patient outcomes. As digital dentistry evolves, understanding dentists' basic demands for these scanners is crucial for manufacturers, practitioners, and stakeholders aiming to optimize CAD/CAM integrations.

This article delves into the essential requirements dentists have for intraoral scanners in 2025, based on industry reports, clinical studies, and market analyses. These demands focus on core aspects like precision, operational speed, user-friendliness, system compatibility, cost-effectiveness, and support services. By addressing these, IOS technology not only streamlines workflows but also improves global dental care standards.

The intraoral scanners segment within the CAD/CAM market is experiencing significant momentum. Valued at around $824.7 million globally in 2025, it is expected to expand to $1.58 billion by 2034, achieving a CAGR of 7.53%. This growth is propelled by factors such as rising geriatric populations in Europe and Asia, increasing awareness of oral health in developing regions, and the push for same-day restorations in the US.

In the United States, where dental insurance often covers advanced procedures, dentists demand scanners that integrate seamlessly with existing CAD/CAM systems to reduce chair time. European markets, particularly in Germany and the UK, emphasize regulatory compliance and high-precision tools for complex cases like implants. In Asia-Pacific, including China and Japan, cost sensitivity drives the need for affordable yet reliable devices, with a focus on scalability for high-volume clinics.

Key drivers include productivity gains of 30-50% post-adoption, as scanners eliminate messy molds and enable real-time diagnostics. However, challenges like high initial costs and training needs persist, especially in rural areas of developing countries. Despite these, the market's trajectory underscores a shift toward patient-centered, efficient digital solutions.

Accuracy remains the foremost demand for dentists using intraoral scanners in 2025. With deviations as low as 5-20 micrometers (μm) for full-arch scans, high precision ensures optimal fit for restorations, implants, and orthodontic appliances. Dentists require scanners that deliver trueness (closeness to actual anatomy) and repeatability, minimizing errors that could lead to remakes and increased costs.

In clinical settings, precision is vital for applications like implant planning, where sub-10 μm accuracy in single-tooth scans prevents complications. Studies indicate that AI-enhanced error correction can improve accuracy by 20-30%, automatically refining artifacts from saliva or movement. For global practitioners, this demand is universal: US dentists seek FDA-compliant devices for legal assurance, while Asian clinics prioritize cost-effective high-precision options to handle diverse patient anatomies.

Visual comparisons highlight the difference: A 5 μm scan captures intricate details like margins and undercuts with clarity, whereas 30 μm may introduce distortions, affecting outcomes in regions with high restorative demands like Europe.

Speed is a critical demand, as it directly impacts clinic throughput and patient satisfaction. In 2025, dentists expect full-arch scans in under 60 seconds, with frame rates of 50-70 fps enabling seamless data stitching. AI algorithms further reduce processing time by up to 50%, allowing for same-day procedures that boost case acceptance by 40%.

For busy practices in urban centers like Tokyo or Los Angeles, efficient workflows mean handling more patients daily without compromising quality. Regional variations exist: In Europe, where regulatory timelines are strict, speed facilitates compliance; in Asia, it addresses high patient volumes. Overall, scanners that minimize rescans through real-time quality checks are essential, contributing to 20-30% more cases handled annually.

Ease of use is paramount to encourage adoption among dentists with varying tech proficiency. In 2025, demands include lightweight wands under 250 grams, compact tips for pediatric or small-mouth patients, and wireless designs for mobility. Anti-fog features and intuitive interfaces with touchscreen controls reduce the learning curve to less than a week.

Dentists in the US and Europe value ergonomic advancements that prevent fatigue during long sessions, while in Asia, user-friendly software with multilingual support aids widespread implementation. Clinical data shows that such designs increase adoption rates by 25%, ensuring consistent scan quality and fewer errors.

Integration with CAD/CAM ecosystems is a non-negotiable demand. Dentists require open-file formats like STL and PLY for compatibility with third-party software, enabling cloud-based collaborations and remote consultations. In 2025, features such as color scanning for tissue differentiation, near-infrared imaging for caries detection, and AI tools for automatic occlusion analysis expand functionality.

Globally, open systems dominate with over 95% market share, allowing flexibility in diverse settings—from US chairside mills to Asian lab partnerships. This demand supports telemedicine in remote areas, enhancing diagnostic accuracy by 15-20% and fostering comprehensive care.

Cost remains a barrier, but dentists demand scanners with strong ROI. Entry-level models start at $4,000-$10,000, while premium ones reach $50,000, with no or low annual subscriptions preferred to minimize total ownership costs. Payback periods of 1-2 years are achievable through material savings (up to 50%) and reduced remakes.

In cost-sensitive markets like Asia and Latin America, affordable options with free upgrades are prioritized, whereas in the US and Europe, value is measured by productivity gains and higher patient acceptance. Institutional procurements, such as bulk orders for veterans' affairs, underscore the emphasis on long-term economic viability.

After-sales support is essential for sustained use. Dentists demand 1-3 year warranties, rapid response times under 24 hours, and free software updates. Comprehensive training—online modules, on-site sessions, and community resources—accelerates proficiency and reduces downtime by 30%.

Regionally, local service networks are crucial: In Europe, compliance-focused support; in Asia, multilingual resources. Strong support builds confidence, ensuring scanners integrate smoothly into practices worldwide.

In the 2025 CAD/CAM market, dentists' demands for intraoral scanners revolve around balancing precision, efficiency, and practicality to deliver superior patient care. As the market grows at 7-9% CAGR, addressing these needs will drive adoption across the US, Europe, Asia, and emerging regions. Practitioners should evaluate scanners through trials, focusing on ROI and integration to future-proof their workflows. By prioritizing these essentials, digital dentistry can achieve greater accessibility and innovation globally.

Dry & wet milling for zirconia, PMMA, wax with auto tool changer.

learn more

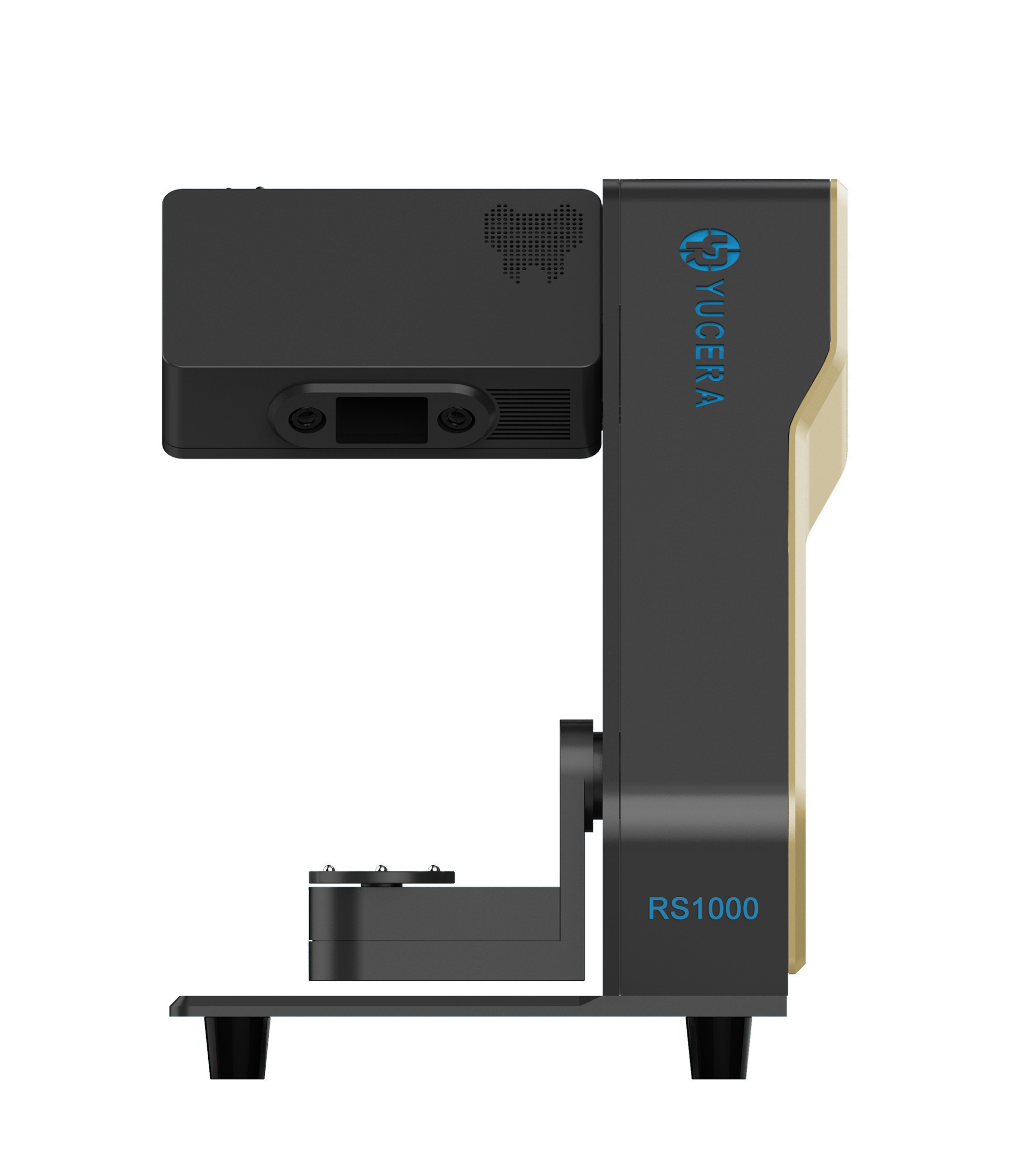

High-precision 3D scanning, AI calibration, full-arch accuracy.

learn more

40-min full sintering with 57% incisal translucency and 1050 MPa strength.

learn more

40-min cycle for 60 crowns, dual-layer crucible and 200°C/min heating.

learn more

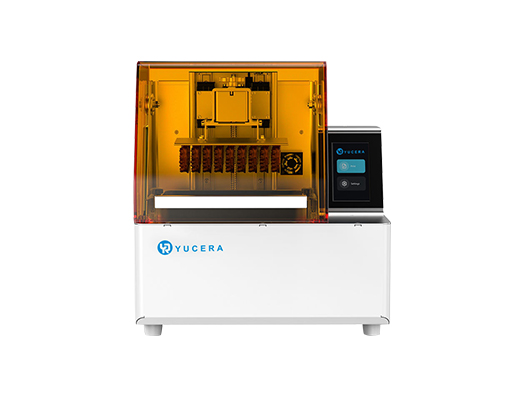

High-speed LCD printer for guides, temporaries, models with 8K resolution.

learn more